On-going delays at South African ports and congestion. Suppliers are looking at all shipping opportunities in all ports and are even trucking fruit from long distances (Cape Town to Durban) to ensure that fruit is exported to all their customers in all markets across the world.

Durban is South Africa’s busiest citrus port and exporters are looking at opportunities to start shipping from Maputo port to help alleviate the congestion at the port. At this stage, limited containers are being planned out of Maputo port to Far East countries and if this works, this could open the door for more exports out of Maputo port during the citrus season.

Fruit Logistica 2022 in Berlin is running from 05-07 April and has attracted buyers and professional visitors from 115 countries with around 2,000 exhibitors from 87 countries.

There is a slight increase in demand for lemons and this can be contributed to less volume being shipped to the Middle East as more volume has been diverted to Europe.

There was no significant change in market trends pre-Ramadan and the Middle East market seems to be at the same sales rate. The holy month of Ramadan will be for one month in the Middle East from the 02 April and will end on 01 May 2022.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 86.38 BDT (Bangladeshi Taka) |

| 1.00 USD = 75.92 INR (Indian Rupees) |

| 1.00 USD = 14.73 ZAR (South African Rand) |

Citrus

Lemons exports to the Middle East are 11% down compared to the same period last season and this is due to more volume being diverted to Europe.

The Valencia 2022 estimate is anticipated to be 58.2 million cartons (6% growth), however as the season progresses, it will be determined what volume will be exported due to the cost implications of increasing freight rates.

The Navel 2022 estimate is anticipated to be 28.7 million cartons (6% growth), and this growth is because of later navel varieties.

The Valencia Farmers Association in Spain estimates that damage due to a cold front and rains have cost more than EUR 25 million to local crops with damage to citrus, stone fruit, and persimmons.

Market update on Citrus from South Africa

There has been a slight increase in demand for lemons in the GCC countries and this can be contributed to fewer lemons being shipped to the Middle East during the last week.

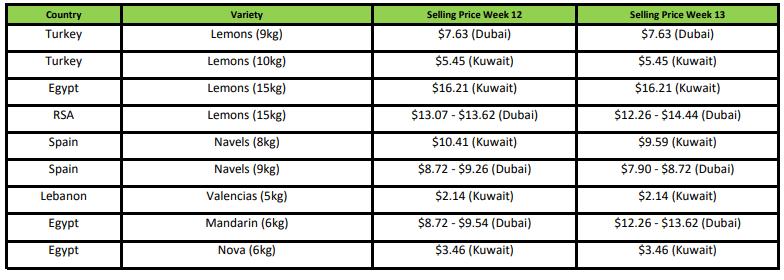

Market Prices (Dubai and Kuwait)

Pome

The Golden Delicious apples are bigger in size this season and there is more pressure to move higher volumes of bigger sizes this season.

By the end of week 13, apple exports to the Middle East were up by 32% and pears were up by 3%.

Market update

The market still has a high volume of summer pears, and this is causing pressure to move the new season winter pear varieties such as Forelle and Vermont Beaut pears.

A continued increase in demand for Royal gala apples from South Africa, Europe, and other countries. The GCC countries want to start with supply from Chile, however high freight rates are pushing the price levels too high.

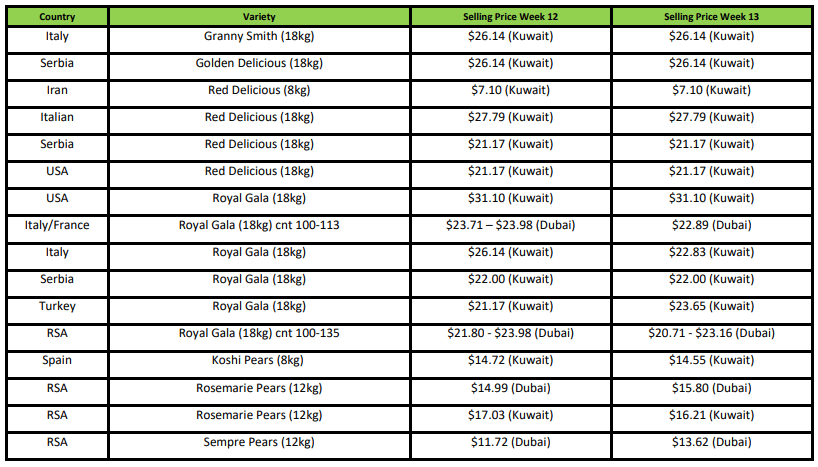

Market Prices (Dubai and Kuwait)

Grape, Stone & Kiwi Fruit

Update on Grapes and a market update in the GCC countries

South Africa is almost finished with grapes.

There was an increase of 33% in grape exports to the Middle East from South Africa by end of week 13.

Chile has 2-3 weeks left on the packing of Red Globe grapes.

There is still a demand for Red grapes in the GCC countries.

Update on Kiwi Fruit and a market update in the GCC countries

Zespri’s new Ruby Red variety will enter the Asian markets in the 2022 season

In addition to Kiwi fruit from Italy, there is also Zespri Kiwi fruit available on the local market at competitive price levels. Chilean Kiwi fruit will compete with these brands at lower price levels currently available in the market.

There has been a good demand for Kiwi fruit in the European market over the past few years, however, the 2022 season will be different with a shorter than the average European season. Also, because of the current ban on exports to Russia, supply intended for Russia is expected to be diverted to other European countries. In general, there has been a drop in prices and consumption of fruit, and with kiwifruit stocks currently in Europe, this is going to be a challenge for the Chilean Kiwifruit that will start soon. The European season is also extended for at least another month and therefore lower volumes of Kiwi fruit will be able to enter the market.

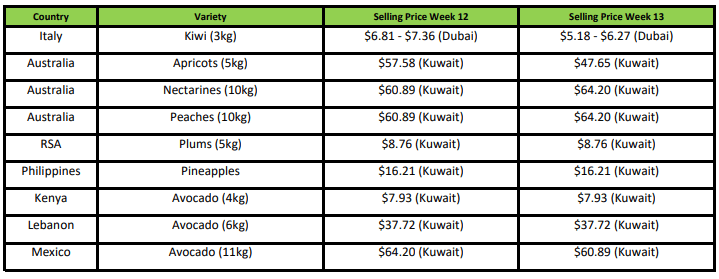

Market Prices (Dubai and Kuwait)

India / Bangladesh

India

No report.

Bangladesh

No report.

PPECB Statistics

Decofrut Statistics

Follow links to our social pages