In the GCC countries, the sales and price levels for most commodities picked up pre-Ramadan and the first week after Ramadan but started to decline thereafter.

In the Kingdom of Saudi Arabia, there has been a spike in the number of covid-19 cases over the past two days and the Minister has already warned of re-imposing lockdown measures if the public doesn’t obey the rules. In January, Saudi Arabia postponed the end of the ban on travel for all their citizens and re-opened all entry points until the 17th May 2021, however, in February the Government suspended entry for all non-citizens from 20 states except for diplomates and medical practitioners.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 84.84 BDT (Bangladeshi Taka) |

| 1.00 USD = 74.99 INR (Indian Rupees) |

| 1.00 USD = 14.31 ZAR (South African Rand) |

Citrus

Citrus – South Africa

The revised estimated forecast volume on Citrus

Grapefruit : 18 million cartons

Lemons : 30.2 million cartons

Navels : 26.3 million cartons

Valencias : 58 million cartons

Soft Citrus : 30.5 million cartons

A normal navel crop is expected with a slightly higher crop expected for the Valencia season. However, a higher crop is expected on Grapefruit, Lemons and Soft Citrus although Lemon volumes exported until the end of week 15 are still down.

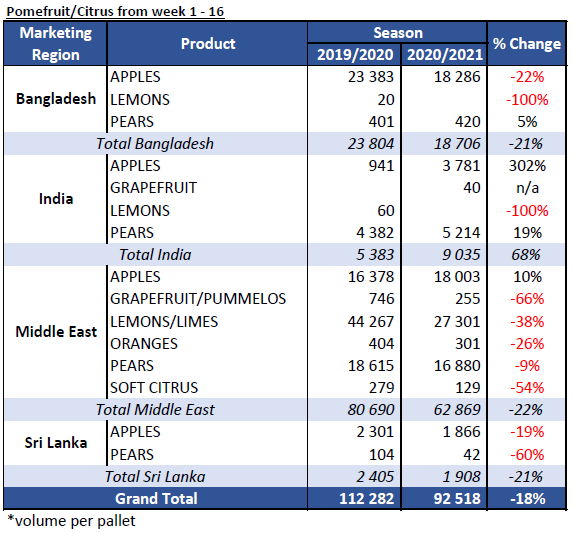

Lemons to the Middle East – a decrease of 38% on cumulative volumes shipped to date compared to the 2020 season.

Market update: Price levels for South African lemons remained at high levels in the GCC countries the week before Ramadan and held at these levels for the first week of Ramadan (week 15) and thereafter a significant drop in price high levels from week 16 as the demand decreased.

The market is still supplied with oranges from Spain and Morocco, however both countries should be finished by the end of May and then there should be a good opportunity for South African navels.

In general, Spanish citrus exports have grown by 4.63 % this season and this growth has been in mandarins and grapefruit.

Market Prices

| Country | Commodity | Selling Prices week 15 | Selling Prices week 16 |

|---|---|---|---|

| Lebanon | Navels (6kg) | $3.95 (Kuwait) | $3.62 (Kuwait) |

| Egypt | Navels (7kg) | $6.10 (Kuwait) | $5.28 (Kuwait) |

| Egypt | Navels (7.5kg) | $6.67 – $7.73 (Jeddah) | $7.20 – $8.00 (Jeddah) |

| Spain | Lane Late Orange (9kg) | $10.13 – $11.47 (Jeddah) | $10.13 – $12.00 (Jeddah) |

| Spain | Navels (9kg) | $10.90 (Dubai) | $10.35 (Dubai) |

| Lebanon | Navels (14kg) | $10.07 (Kuwait) | $10.24 (Kuwait) |

| Egypt | Navels (15kg) | $13.55 (Kuwait) | |

| Spain | Navels (15kg) | $10.24 (Kuwait) | $10.24 (Kuwait) |

| RSA | Navels (15kg) | $13.07 – $14.17 (Dubai) | |

| Turkey | Lemons (5kg) | $1.97 (Kuwait) | $1.97 (Kuwait) |

| Turkey | Lemons (10kg) | $6.10 (Kuwait) | $5.10 (Kuwait) |

| Turkey | Lemons (15kg) | $12.55 (Kuwait) | |

| Egypt | Lemons (15kg) | $10.90 (Kuwait) | |

| RSA | Lemons (15kg) | $14.21 (Kuwait) | $14.03 (Kuwait) |

| RSA | Lemons (15kg) cnt 113/138/162 | $20.80 – $22.67 (Jeddah) | $16.00 – $17.33 (Jeddah) |

| RSA | Lemons (15kg) | $16.35 – $19.55 (Dubai) | $14.99 – $19.55 (Dubai) |

| Lebanon | Valencias (5kg) | $1.63 (Kuwait) | $1.47 (Kuwait) |

| Egypt | Valencias (7.5kg) | $1.97 (Kuwait) | $1.97 (Kuwait) |

| Egypt | Valencias (15kg) | $6.93 (Kuwait) | $6.10 (Kuwait) |

| Egypt | Valencias (15kg) cnt 72-100 | $6.13 – $8.53 (Jeddah) | $6.13 – $8.53 (Jeddah) |

| Lebanon | Soft Citrus (5kg) – Nova | $1.47 (Kuwait) | $1.30 (Kuwait) |

| Egypt | Soft Citrus (8kg) – Nova | $2.79 (Kuwait) | $2.29 (Kuwait) |

| Morocco | Mandarin (10kg) | $16.00 – $17.33 (Jeddah) | $13.87 – $16.00 (Jeddah) |

| Pakistan | Soft Citrus (10kg) | $6.76 (Kuwait) | |

| Morocco | Soft Citrus (10kg) | $9.24 (Kuwait) | $8.41 (Kuwait) |

| Spain | Soft Citrus (10kg) | $9.27 (Kuwait) | $9.24 (Kuwait) |

| Turkey | Grapefruit (7kg) | $5.28 (Kuwait) | $5.28 (Kuwait) |

| RSA | Grapefruit (15kg) | $17.71 (Dubai) |

Pome

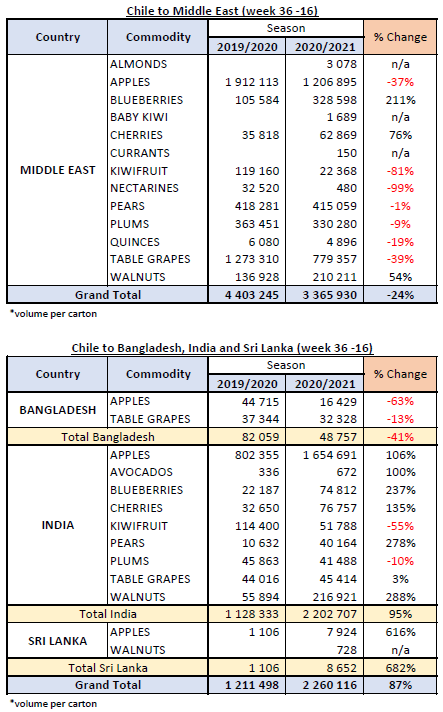

Continued increase in price levels on Royal Gala apples due to the shortage of volume from Chile and South Africa especially on the big sizes in general. Argentina are at the tail-end of their season on Royal gala apples and Brazil are facing the same logistical challenges as South Africa in getting equipment due to the shortage from all shipping lines.

Shipped YTD from South Africa

Apples to the Middle East – an increase of 10% on cumulative volumes shipped to date compared to the 2020 season.

Pears to the Middle East – a decrease of 9% on cumulative volumes shipped to date compared to the 2020 season.

Market Prices

| Country | Commodity | Selling Prices week 15 | Selling Prices week 16 |

|---|---|---|---|

| Italy | Granny Smith (18kg) | $28.45 (Kuwait) | $27.62 (Kuwait) |

| Serbia | Granny Smith (18kg) | $28.45 (Kuwait) | $26.79 (Kuwait) |

| Italy / France | Granny Smith (18kg) | $21.25 – $24.70 (Dubai) | $20.44 – $24.25 (Dubai) |

| Italy | Granny Smith (18kg) cnt 100/113/125 | $20.00 – $21.33 (Jeddah) | $20.00 – $21.33 (Jeddah) |

| Greece | Granny Smith (18kg) | $26.79 (Kuwait) | |

| France | Granny Smith (18kg) | $28.45 (Kuwait) | $28.45 (Kuwait) |

| USA | Granny Smith (18kg) | $28.45 (Kuwait) | $28.45 (Kuwait) |

| France | Golden Delicious (18kg) | $23.48 (Kuwait) | $21.83 (Kuwait) |

| Italy | Golden Delicious (18kg) | $25.14 (Kuwait) | |

| Turkey | Golden Delicious (18kg) | $21.00 (Kuwait) | |

| RSA | Golden Delicious (18kg) | $20.17 (Kuwait) | |

| Italy / France | Golden Delicious (18kg) | $25.00 – $25.25 (Dubai) | $25.00 – $25.25 (Dubai) |

| USA | Red Delicious – PR (18kg) cnt 100-113 | $28.00 (Jeddah) | $28.00 (Jeddah) |

| USA | Red Delicious – XF (18kg) cnt 100-113 | $24.53 – $25.33 (Jeddah) | $24.53 – $25.33 (Jeddah) |

| USA | Red Delicious (18kg) | $25.96 (Kuwait) | $27.62 (Kuwait) |

| Italy | Red Delicious (18kg) | $25.14 (Kuwait) | $20.17 (Kuwait) |

| China | Fuji (18kg) | $20.17 (Kuwait) | $6.86 (Kuwait) |

| RSA | Royal Gala – Econo packs (12kg) cnt 120- 135 | $17.65 – $17.85 (Dubai) | $17.65 – $17.85 (Dubai) |

| Greece | Royal Gala (18kg) | $21.83 (Kuwait) | |

| Serbia | Royal Gala (18kg) | $25.14 (Kuwait) | $23.48 (Kuwait) |

| Italy | Royal Gala (18kg) cnt 100 – 138 | $25.87- $27.47 (Jeddah) | $24.80- $26.67 (Jeddah) |

| Italy | Royal Gala (18kg) | $25.14 (Kuwait) | $23.48 (Kuwait) |

| USA | Royal Gala (18kg) | $27.62 (Kuwait) | |

| RSA | Royal Gala (18kg) | $21.48 (Kuwait) | |

| New Zealand | Royal Gala (18kg) | $26.79 (Kuwait) | |

| Brazil | Royal Gala (18kg) cnt 113-125 | $24.00 – $24.25 (Dubai) | $24.00 – $24.25 (Dubai) |

| RSA | Royal Gala (18kg) cnt 120 | $22.62 – $24.25 (Dubai) | $23.16 – $24.70 (Dubai) |

| RSA | Royal Gala (18kg) cnt 135 | $26.13 – $26.67 (Jeddah) | $25.87 – $26.13 (Jeddah) |

| RSA | Royal Beaut (18kg) cnt 120-135 | $28.00 – $28.25 (Dubai) | $28.00 – $28.25 (Dubai) |

| RSA | Bigbucks (Flash Gala) (18kg) cnt 110 | $22.00 – $22.25 (Dubai) | $22.00 – $22.25 (Dubai) |

| Chile | Royal Gala (18kg) cnt 100-150 | $26.67 – $28.80 (Jeddah) | $26.67 – $28.80 (Jeddah) |

| Turkey | Pears (4kg) | $6.10 (Kuwait) | $5.28(Kuwait) |

| Spain | Pears (8kg) | $14.38 (Kuwait) | $15.21 (Kuwait) |

| RSA | Flamingo Pears (12kg) cnt 90/96/112/120 | $15.73 – $18.13 (Jeddah) | $17.33 – $20.00 (Jeddah) |

| RSA | Rosemarie/Forelle Pears (12kg) | $14.38 (Kuwait) | $14.38 (Kuwait) |

| RSA | Rosemarie/Forelle Pears (12kg) | $19.00 – $21.80 (Dubai) | $21.80 – $25.25 (Dubai) |

| RSA | Sempre Pears (12kg) cnt 90/96/112/120 | $13.33 – $15.47 (Jeddah) | $15.47 – $17.33 (Jeddah) |

| RSA | Sempre Pears (12kg) | $11.90 (Kuwait) | $11.90 (Kuwait) |

| RSA | Sempre/Vermont Pears (12kg) | $19.07 (Dubai) | $20.44 – $24.25 (Dubai) |

| RSA | Cape Rose (Cheecky) Pears (12kg) | $14.00 – $14.65 (Dubai) | $15.00 – $15.25 (Dubai) |

| Chile | Coscia Pears (8.2kg) | $15.00 – $15.25 (Dubai) | $14.40 – $14.65 (Dubai) |

Grape, Stone & Kiwi Fruit

Stone fruit

There was a slight increase in price levels for South African Angelino plums in the GCC countries the week before Ramadan and for the first week of Ramadan (week 15) and thereafter prices levels started to decline again. The market in general is oversupplied with plums from South Africa and volumes of plums from Chile are also starting to make arrival in the market.

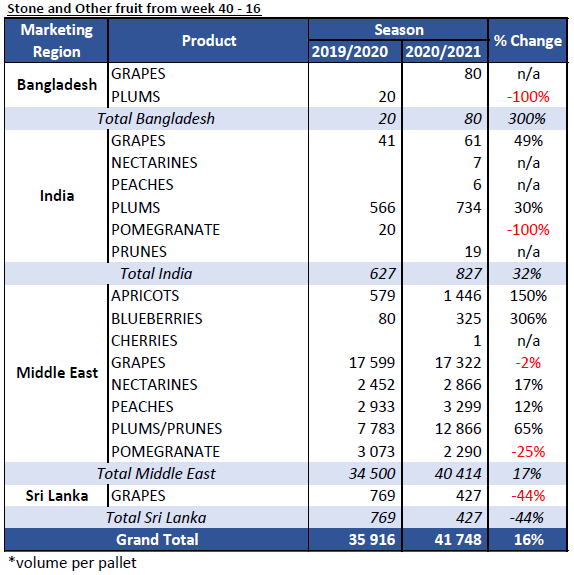

Shipped YTD from South Africa

Plums to the Middle East – an increase of 65% on cumulative volumes shipped to date compared to the 2020 season.

Kiwi fruit

On the kiwifruit there is always a very high demand out of Europe and the USA and these markets received the highest volume of Kiwi fruit from Chile last season. Besides Europe and the USA, last season there was a huge worldwide demand for Kiwi fruit due to the high vitamin C content which consumers were wanting due to the Coronavirus and there was a global shortage of Kiwi fruit. This season is no different and there is already a high global demand for Kiwi fruit with limited supply from Chile. Kiwi fruit volumes are down and will continue to reduce each year due to crops being taken out. The GCC countries will compete with Europe and other markets for Kiwi fruit and at high price levels.

Market Prices

| Country | Commodity | Selling Prices week 15 | Selling Prices week 16 |

|---|---|---|---|

| Italy | Kiwi (3kg) | $8.00 – $8.72 (Dubai) | $9.53 – $10.30 (Dubai) |

| Iran | Kiwi (10kg) | $13.60 (Dubai) | $14.00 (Dubai) |

| RSA | Plums ( 5 kg) – Red and Black | $6.81 – $7.63 (Dubai) | $7.50 – $9.54 (Dubai) |

| RSA | Plums (5kg) | $8.59 (Kuwait) | $5.28 (Kuwait) |

| RSA | Plums – Yellow | $7.50 (Dubai) | $7.50 (Dubai) |

| RSA | Nectarines (3kg) | $5.28 (Kuwait) | $8.59 (Kuwait) |

| RSA | Nectarines (2.3kg) | $6.93 – $8.00 (Jeddah) | |

| RSA | Nectarines | $3.27 – $5.00 (Dubai) | $5.00 (Dubai) |

| Chile | Plums Angelino (9kg) | $11.46 – $12.00 (Jeddah) | $11.46 – $12.00 (Jeddah) |

| RSA | Peaches | $6.81 – $9.50 (Dubai) | $6.81 – $8.00 (Dubai) |

| India | White Grapes | $6.54 (Dubai) | $6.81 (Dubai) |

| Australia | White Grapes | $21.80 (Dubai) | $18.53 (Dubai) |

| RSA | Red Seedless | $8.00 – $13.00 (Dubai) | $8.00 – $12.25 (Dubai) |

| RSA | Red Globe (4.5kg) | $10.67 – $11.20 (Jeddah) | |

| Chile | Red Globe (8.2kg) | $23.47 – $24.00 (Jeddah) | $21.33 – $21.87 (Jeddah) |

| RSA | Black Grapes | $8.00 (Dubai) | $8.00 (Dubai) |

| India | Black Grapes | $7.63 (Dubai) | $7.63 (Dubai) |

| RSA | Pomegranates (3kg) | $13.60 (Dubai) | $13.60 (Dubai) |

India / Bangladesh

India

All cities now going into full lock down. Plum sales stopped in total. All other fruit sales very slow. Only apples still showing good movement.

Bangladesh

The market in Bangladesh continues to tick over slowly but steadily, which is to be expected as a result of the lockdown.

Apple prices have declined a little, possibly pushing profits into the red on some varieties.

All commodities are moving slowly, fortunately however this is still a far better situation than the losses experienced under lockdown this time last year.

The excessive volume of date imports this year has kicked pricing to the ground with supply outstripping demand.

PPECB Statistics

Decofrut Statistics

Follow links to our social pages