With the increase in demand for containers for dry cargo, there is a serious shortage of vessel space globally and this is the driving force behind the ongoing freight increases. In the past, reefer containers were given preference because payments were higher but now, they are competing with dry cargo containers paying higher prices.

The market sales rate has picked up over the last week due to pre-Eid sales. Eid will be between the 30th of April and the 2nd of May 2022.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 86.43 BDT (Bangladeshi Taka) |

| 1.00 USD = 76.38 INR (Indian Rupees) |

| 1.00 USD = 15.88 ZAR (South African Rand) |

Citrus

The packing of the first Nova Soft citrus up North started this week (week 17).

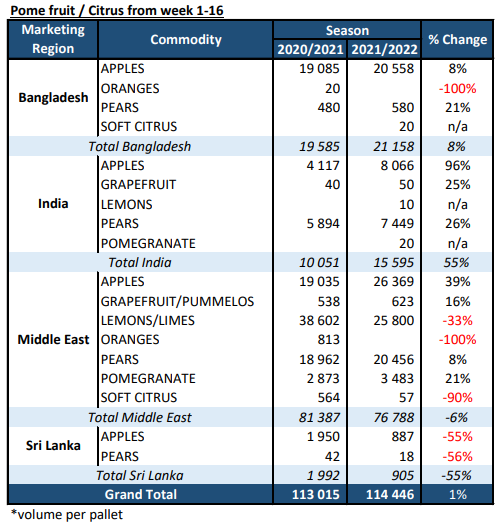

By the end of week 16, there was a decrease of 33% of lemons shipped to the Middle East compared to the same period last season.

Due to the rain, the season for Navel oranges is starting later than anticipated. Last season there were just over 800 pallets shipped to the Middle East compared to the same period this season.

Market update on Citrus from South Africa

Although packing of the first oranges is delayed from South Africa due to the rain, the market is currently supplied with navel oranges from Spain and Egypt.

There was a slight increase in the price level of lemons in the Middle East market and this can be contributed to pre-Eid sales and lower volumes being shipped from South Africa to the Middle East.

Market Prices (Dubai and Kuwait)

Pome

Apples shipped from Chile are down by 48% compared to the same time last season, and this is mainly due to the high freight rates from Chile. This is making it almost impossible to ship apples to the Middle East, as the market can’t pay for the fruit at these price levels. Combined apple shipments from both Chile and South Africa are down by -18% compared to the same time last season.

There has only been an 8% increase in pears shipped YTD from South Africa to the Middle East compared to the same period last season.

Market update

Continued high demand for Royal Gala and green apples at high price levels with limited availability from South Africa, Chile, and the European season is finished.

Market Prices (Dubai and Kuwait)

Grape, Stone & Kiwi Fruit

Update on Kiwi Fruit and a market update in the GCC countries

The first Kiwi fruit volumes to the Middle East were shipped in week 14 but in very limited volumes. Kiwi fruit volumes started picking up in weeks 15 and 16 and by the end of week 16, there were 43 containers of Kiwi fruit shipped to the Middle East.

Higher volumes of Kiwi fruit from Chile are being sent to other countries including India and supermarket programs in the USA while Europe still has its own local supply of Kiwi fruit.

Market Prices (Dubai and Kuwait)

India / Bangladesh

India

High prices apples from SA are finding resistance from consumers. Flash gala is flooding the market and struggling to sell while Royal Beaut and Royal Gala Red are in the market. Cheeky prices are at an all-time low. The market is bad and worse is expected with a rise in Covid and runaway inflation.

Bangladesh

MSC and Maersk shipping rates are excessive and keep increasing monthly. Royal Gala prices have increased. Goldens are still selling at very low prices causing huge losses for importers. It will be a very difficult citrus season with these high freight rates.

PPECB Statistics

Decofrut Statistics

Follow links to our social pages