Due to the Covid 19 situation, several GCC countries have issued guidelines to maintain public health during Eid Al Fitr this year. Several countries have also announced new regulations for the holiday due to the Covid situation. Oman announced it would be canceling Eid prayers and gatherings of any kind in public places and a ban on family gatherings during Eid celebrations.

Despite the build-up to Eid celebrations and the anticipation that market sales would increase ….. this has not happened and market sales remain slow.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 84.75 BDT (Bangladeshi Taka) |

| 1.00 USD = 73.62 INR (Indian Rupees) |

| 1.00 USD = 14.25 ZAR (South African Rand) |

Citrus

Citrus – South Africa

Despite high volumes of lemons that was shipped to the Middle East in week 16, there is still less volume shipped from South Africa compared to same period last season. However, the gap is becoming smaller.

The latest update on Lemon inspections passed for export YTD by the end of week 17 was down by 9% to all countries. However, there is an overall increase in both orange and soft citrus volumes to the Middle East compared to the same period last season.

Due to the high demand and price levels in both China and Europe for Grapefruit, growers/suppliers are predominately packing for these markets and the Middle East will compete with these countries for Grapefruit and at high price levels.

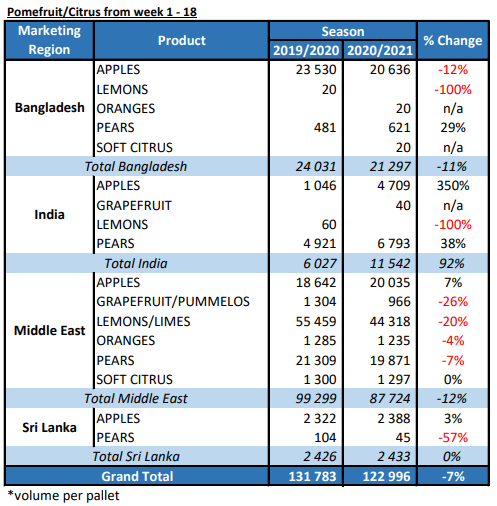

Shipped YTD from South Africa

Lemons to the Middle East – a decrease of 20% on cumulative volumes shipped to date compared to the 2020 season.

Grapefruit to the Middle East – a decrease of 26% on cumulative volumes shipped to date compared to the 2020 season.

Market update: Continued market pressure and decline in Price levels for South African lemons due to volumes that are starting to arrive in the GCC countries. In Saudi Arabia, lemons are also starting to arrive from Dubai, contributing to the decrease in price levels.

Continued downward trend in price levels for Egyptian valencias that are not performing well in the market. Fortunately, the Egyptian valencias are almost finished.

In Dubai, the first Star Ruby Grapefruit has made its arrival from South Africa with high price levels due to the limited supply.

Market Prices

| Country | Commodity | Selling Prices week 17 | Selling Prices week 18 |

|---|---|---|---|

| Lebanon | Navels (6kg) | $3.26 (Kuwait) | $3.72 (Kuwait) |

| Egypt | Navels (7kg) | $2.95 (Kuwait) | $2.62 (Kuwait) |

| Egypt | Navels (7.5kg) | $7.20 – $8.00 (Jeddah) | $4.80 – $5.87 (Jeddah) |

| Spain | Lane Late Orange (9kg) | $10.67 – $12.80 (Jeddah) | $10.67 – $12.80 (Jeddah) |

| Spain | Navels (9kg) | $9.54 (Dubai) | $8.99 (Dubai) |

| Lebanon | Navels (14kg) | $9.24 (Kuwait) | $8.24 (Kuwait) |

| Egypt | Navels (15kg) | $10.07 (Kuwait) | $9.07 (Kuwait) |

| Spain | Navels (15kg) | $10.90 (Kuwait) | $10.11 (Kuwait) |

| RSA | Navels (15kg) | $12.53 – $15.00 (Dubai) | $12.26 (Dubai) |

| Turkey | Lemons (5kg) | $1.43 (Kuwait) | $1.09 (Kuwait) |

| Turkey | Lemons (10kg) | $5.10 (Kuwait) | $4.11 (Kuwait) |

| Turkey | Lemons (15kg) | $10.07 (Kuwait) | $9.08 (Kuwait) |

| RSA | Lemons (15kg) | $12.13 (Kuwait) | $11.11 (Kuwait) |

| RSA | Lemons (15kg) cnt 113/138/162 | $16.00 – $17.33 (Jeddah) | $13.33 – $14.67 (Jeddah) |

| RSA | Lemons (15kg) | $13.62 – $17.40 (Dubai) | $10.90 – $15.00 (Dubai) |

| Egypt | Valencias (7.5kg) | $2.30 (Kuwait) | $2.30 (Kuwait) |

| Egypt | Valencias (15kg) | $6.10 (Kuwait) | $6.10 (Kuwait) |

| Egypt | Valencias (15kg) cnt 72-100 | $6.13 – $8.53 (Jeddah) | $6.67 – $9.33 (Jeddah) |

| Lebanon | Soft Citrus (5kg) – Nova | $1.63 (Kuwait) | $1.97 (Kuwait) |

| Egypt | Soft Citrus (8kg) – Nova | $3.29 (Kuwait) | $3.22 (Kuwait) |

| Morocco | Mandarin (10kg) | $13.87 – $16.00 (Jeddah) | $16.00 – $17.33 (Jeddah) |

| Pakistan | Soft Citrus (10kg) | $6.76 (Kuwait) | $5.28 (Kuwait) |

| Morocco | Soft Citrus (10kg) | $9.24 (Kuwait) | $9.72 (Kuwait) |

| Morocco | Nadorcott (10kg) | $11.72 – $13.62 (Dubai) | $11.72 – $13.62 (Dubai) |

| Spain | Soft Citrus (10kg) | $9.24 (Kuwait) | $10.05 (Kuwait) |

| RSA | Grapefruit (7kg) | $8.27 (Kuwait) | $10.27 (Kuwait) |

| RSA | Grapefruit (15kg) | $17.71 (Dubai) | $13.62 – $19.00 (Dubai) |

Pome

Continued increase in price levels on Royal Gala apples due to the shortage of volume from Chile and South Africa especially on the big sizes in general.

The latest update on apple inspections from South Africa and passed for export YTD by the end of week 17 was up by +17% to all countries. Higher volumes of apples are currently being shipped to the UK, Europe and Far East.

In Saudi Arabia, the first Forelle pears have started to make arrival and the market remains strong and at high price levels. However, in Dubai Forelle pears held at high prices during week 17 but during the course of week 18 there has been a significant drop in price levels.

Shipped YTD from South Africa and Chile

Apples from South Africa to the Middle East – an increase of 7% on cumulative volumes shipped to date compared to the 2020 season.

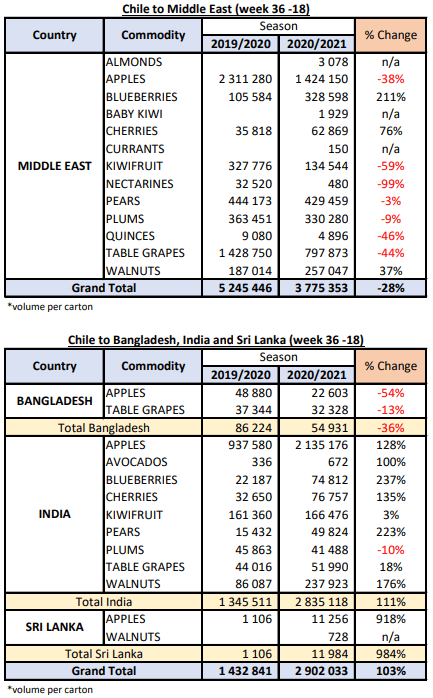

Apples from Chile to the Middle East – a decrease of 38% on cumulative volumes shipped to date compared to the 2020 season.

Pears from South Africa to the Middle East – a decrease of 7% on cumulative volumes shipped to date compared to the 2020 season.

Market Prices

| Country | Commodity | Selling Prices week 17 | Selling Prices week 18 |

|---|---|---|---|

| Italy | Granny Smith (18kg) | $28.45 (Kuwait) | $28.45 (Kuwait) |

| Serbia | Granny Smith (18kg) | $28.45 (Kuwait) | $28.45 (Kuwait) |

| Italy / France | Granny Smith (18kg) | $23.00 – $23.25 (Dubai) | $23.00 – $23.25 (Dubai) |

| Italy | Granny Smith (18kg) cnt 100/113/125 | $20.00 – $21.33 (Jeddah) | $21.33 – $22.67 (Jeddah) |

| RSA | Granny Smith (18kg) | $19.07 (Dubai) | $17.17 (Dubai) |

| Ukraine | Golden Delicious (18kg) | $21.83 (Kuwait) | $21.83 (Kuwait) |

| France | Golden Delicious (18kg) | $25.14 (Kuwait) | $25.14 (Kuwait) |

| Italy | Golden Delicious (18kg) | $25.14 (Kuwait) | $25.14 (Kuwait) |

| Turkey | Golden Delicious (18kg) | $21.00 (Kuwait) | $21.00 (Kuwait) |

| RSA | Golden Delicious (18kg) | $20.17 (Kuwait) | $20.17 (Kuwait) |

| Italy / France | Golden Delicious (18kg) | $25.00 – $25.25 (Dubai) | $26.00 – $26.25 (Dubai) |

| USA | Red Delicious – PR (18kg) cnt 100-113 | $28.00 (Jeddah) | $28.00 (Jeddah) |

| USA | Red Delicious – XF (18kg) cnt 100-113 | $24.53 – $25.33 (Jeddah) | $24.53 – $25.33 (Jeddah) |

| USA | Red Delicious (18kg) | $25.96 (Kuwait) | $26.79 (Kuwait) |

| France | Red Delicious (18kg) | $20.17 (Kuwait) | $21.83 (Kuwait) |

| China | Fuji (18kg) | $16.86 (Kuwait) | $16.86 (Kuwait) |

| RSA | Royal Gala – Econo packs (12kg) cnt 120- 135 | $20.00 – $20.25 (Dubai) | $20.00 – $20.25 (Dubai) |

| Greece | Royal Gala (18kg) | $21.83 (Kuwait) | $21.83 (Kuwait) |

| Serbia | Royal Gala (18kg) | $24.31 (Kuwait) | $24.31 (Kuwait) |

| Italy | Royal Gala (18kg) | $23.48 (Kuwait) | $23.48 (Kuwait) |

| RSA | Royal Gala (18kg) | $25.14 (Kuwait) | $25.14 (Kuwait) |

| New Zealand | Royal Gala (18kg) PR cnt 110-135 | $32.60 – $32.85 (Dubai) | $29.00 – $32.85 (Dubai) |

| Brazil | Royal Gala (18kg) cnt 113-125 | $24.00 – $24.25 (Dubai) | $24.00 – $24.25 (Dubai) |

| RSA | Royal Gala (18kg) cnt 120 | $23.16 – $26.25 (Dubai) | $24.52 (Dubai) |

| RSA | Royal Gala (18kg) cnt 135 | $25.87 – $26.13 (Jeddah) | $24.80 – $25.33 (Jeddah) |

| RSA | Royal Beaut (18kg) cnt 120-135 | $31.25 – $31.50 (Dubai) | $29.35 – $29.60 (Dubai) |

| Chile | Royal Gala (18kg) cnt 125 – 138 | $26.00 – $26.25 (Dubai) | $26.35 – $26.60 (Dubai) |

| Chile | Royal Gala (18kg) cnt 100-150 | $26.67 – $28.80 (Jeddah) | $26.13 – $28.00 (Jeddah) |

| Turkey | Pears (4kg) | $6.10 (Kuwait) | $6.10 (Kuwait) |

| Spain | Pears (8kg) | $15.21 (Kuwait) | $15.21 (Kuwait) |

| RSA | Forelle Pears (12kg) cnt 90/96/112/120 | $17.33 – $20.00 (Jeddah) | $19.47 – $21.33 (Jeddah) |

| RSA | Rosemarie/Forelle Pears (12kg) | $18.52 (Kuwait) | $18.52 (Kuwait) |

| RSA | Forelle Pears (12kg) | $21.80 – $23.25 (Dubai) | $17.71 – $22.00 (Dubai) |

| RSA | Vermont Pears (12kg) cnt 90/96/112/120 | $15.47 – $17.33 (Jeddah) | $16.80 – $18.67 (Jeddah) |

| RSA | Vermont Pears (12kg) | $16.03 (Kuwait) | $16.86 (Kuwait) |

| RSA | Sempre/Vermont Pears (12kg) | $20.44 – $21.45 (Dubai) | $15.53 – $20.65 (Dubai) |

| Chile | Coscia Pears (8kg) | $14.40 – $14.65 (Dubai) | $14.40 – $14.65 (Dubai) |

| Chile | Pears (8kg) | $16.86 (Kuwait) | $15.21 (Kuwait) |

Grape, Stone & Kiwi Fruit

Stone fruit

The latest update on Plum inspections passed for export YTD by the end of week 17 was up by +71% to all countries.

The GCC countries are still oversupplied on plums and a continued downward trend in price levels due to ongoing market pressure.

Shipped YTD from South Africa and Chile

Plums from South Africa to the Middle East – an increase of 73% on cumulative volumes shipped to date compared to the 2020 season.

Plums from Chile to the Middle East – a decrease of 9% on cumulative volumes shipped to date compared to the 2020 season.

Kiwi fruit

Kiwi fruit volumes shipped from Chile to the Middle East remain low at -60% on cumulative volumes shipped to date compared to the 2020 season. This can be contributed to the high demand from Europe and USA who pay high prices to secure the volumes.

Market Prices

| Country | Commodity | Selling Prices week 17 | Selling Prices week 18 |

|---|---|---|---|

| Italy | Kiwi (3kg) | $9.53 – $11.00 (Dubai) | $8.72 – $11.00 (Dubai) |

| Iran | Kiwi (10kg) | $14.00 (Dubai) | $17.00 (Dubai) |

| RSA | Plums (5 kg) – Red and Black | $7.63 – $8.00 (Dubai) | $7.63 – $9.00 (Dubai) |

| RSA | Plums (5kg) | $8.59 (Kuwait) | $9.41 (Kuwait) |

| RSA | Plums (8kg) | $13.55 (Kuwait) | |

| RSA | Plums – Yellow | $10.00 (Dubai) | $17.00 (Dubai) |

| RSA | Nectarines | $5.00 (Dubai) | $7.00 (Dubai) |

| Chile | Plums Angelino (9kg) | $11.47 – $12.00 (Jeddah) | $11.47 – $12.00 (Jeddah) |

| Chile | Plums | $7.62 – $8.17 (Dubai) | $7.62 (Dubai) |

| RSA | Peaches | $3.27 – $7.00 (Dubai) | $5.00 (Dubai) |

| India | White Grapes | $9.54 (Dubai) | $9.54 (Dubai) |

| RSA | Red Seedless | $11.00 – $12.25 (Dubai) | $10.00 (Dubai) |

| Chile | Red Globe (8.2kg) | $21.75- $22.67 (Jeddah) | $22.40- $22.67 (Jeddah) |

| RSA | Black Grapes | $8.00 (Dubai) | $8.00 (Dubai) |

| India | Black Grapes | $9.54 (Dubai) | $9.54 (Dubai) |

India / Bangladesh

India

There seems no end in sight for the increase in Covid cases in India currently. The forecast is that the daily death rate can double by end of May. This is a tragedy. Grapes, plums and Packhams struggling to sell. Vermonts, Apples and Citrus moving well at high prices. There are no local apples left in the market and imported apples are fetching high prices and should maintain these prices until the local crop starts.

Bangladesh

Price levels on apples continue to slowly claw their way back up with hopes of further improvement over the next week or two. Exports from South Africa are somewhat lower compared to this time last year, however, these numbers will quickly catch up considering the covid-related cessation of shipments to Bangladesh this time last year.

Pear exports from South Africa are up by almost 30% compared to previous season’s figures.

Easy peeler sales are slow to average, with small volumes available from China and Morocco, however things are expected to improve by the time South African soft citrus is set to arrive.

Small volumes of Egyptian Valencia are currently available however prices are high due to soaring freight costs. Chittagong Port will remain open during the Eid Festivities, which is critical in order to avoid exacerbating the already problematic congestion issues.

PPECB Statistics

Decofrut Statistics

Follow links to our social pages