The overall market is slow in the GCC countries especially after Eid and people are also allowed to leave the country to go on vacation.

On Monday, Saudi Arabia lifted a ban on citizens travelling out of the Gulf state without prior permission from authorities.

It was also announced on Thursday that overseas pilgrims will be allowed to perform Hajj this year. Hajj is expected to start on the 17th July 2021 and end on the 22nd July 2021.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 84.80 BDT (Bangladeshi Taka) |

| 1.00 USD = 72.43 INR (Indian Rupees) |

| 1.00 USD = 13.79 ZAR (South African Rand) |

Citrus

Citrus – South Africa

There have been slight adjustments to the 2021 predicted estimates. Although orange volumes remain steady, Grapefruit and Soft citrus volumes have dropped their predicted estimate by 1 million cartons while lemons only dropped by 200,000 cartons.

Revised Estimates

Grapefruit : 18 million to 17 million cartons

Soft Citrus : 30.5 million to 29.5 million cartons

Lemons : 30 million to 29.6 million cartons

Although there has been an overall increase in Soft Citrus volumes shipped to date to the Middle East compared to the same period last season, Nova volumes shipped to the Middle East are down by -27% compared to the same period last season.

Moroccan Navels have just finished in Saudi Arabia and the quality and colour were very good. The early South African navels that arrived in the market with yellow colour could not compete with the Moroccan navels and therefore there is continued downward pressure on price levels for the early South African Navels with poor colour. Oranges from Spain have just finished in Saudi Arabia, however, the quality was not good for the last of the Spanish oranges.

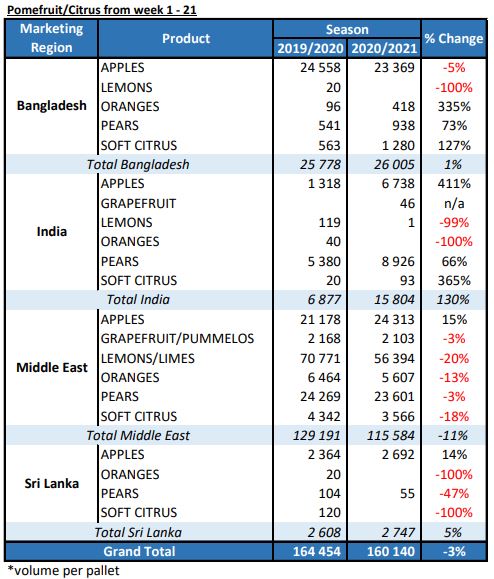

Shipped YTD from South Africa

Lemons to the Middle East – a decrease of 20% on cumulative volumes shipped to date compared to the 2020 season.

Grapefruit to the Middle East – a decrease of 3% on cumulative volumes shipped to date compared to the 2020 season.

Soft Citrus to the Middle East – a decrease of 18% on cumulative volumes shipped to date compared to the 2020 season.

Oranges to the Middle East – a decrease of 13% on cumulative volumes shipped to date compared to the 2020 season.

Market update: Sales are slow for the most part on all commodities and especially after Eid. The GCC countries have a supply of Egyptian valencias in the market at low price levels and good colour. Many customers are storing Egyptian valencias for Hajj in mid-July. Egypt is still packing valencias until the end of June and for reason, the GCC countries will take the later Turkey valencias from South Africa and not the early volumes as these will compete with the Egyptian valencias currently in the market.

Market Prices

| Country | Commodity | Selling Prices week 21 | Selling Prices week 22 |

|---|---|---|---|

| Egypt | Navels (7kg) | $3.29 (Kuwait) | $3.32 (Kuwait) |

| Spain | Navels (9kg) | $8.99 – $9.54 (Dubai) | $8.99 – $9.54 (Dubai) |

| Egypt | Navels (15kg) | $8.91 (Kuwait) | $10.30 (Kuwait) |

| Spain | Navels (15kg) | $11.55 (Kuwait) | $13.63 (Kuwait) |

| RSA | Navels (15kg) | $12.79 (Kuwait) | |

| RSA | Navels (15kg) | $11.72 – $12.26 (Dubai) | $11.72 – $14.00 (Dubai) |

| RSA | Navels (15kg) | $10.67 – $12.00 (Jeddah) | |

| RSA | Lemons (15kg) | $10.35 (Kuwait) | $8.47 (Kuwait) |

| RSA | Lemons (15kg) | $8.17 – $14.00 (Dubai) | $8.17 – $11.00 (Dubai) |

| Lebanon | Valencias (5kg) | $2.79 (Kuwait) | $2.66 (Kuwait) |

| Egypt | Valencias (7.5kg) | $2.30 (Kuwait) | $2.99 (Kuwait) |

| Egypt | Valencias (15kg) | $6.81 – $8.17 (Dubai) | |

| Egypt | Valencias (15kg) | $6.10 (Kuwait) | $6.98 (Kuwait) |

| RSA | Valencias (15kg) | $11.96 (Kuwait) | |

| Egypt | Soft Citrus (8kg) – Nova | $2.79 (Kuwait) | $3.32 (Kuwait) |

| Pakistan | Soft Citrus (10kg) | $5.21 (Kuwait) | $5.31 (Kuwait) |

| Morocco | Soft Citrus (10kg) | $10.21 (Kuwait) | $11.96 (Kuwait) |

| RSA | Soft Citrus (10kg) – Clementine | $10.90 – $11.44 (Dubai) | $10.90 – $15.00 (Dubai) |

| RSA | Soft Citrus (10kg) – Leanri | $13.07 – $13.62 (Dubai) | $13.60 (Dubai) |

| RSA | Soft Citrus (10kg) – Nova | $12.26 (Dubai) | |

| RSA | Soft Citrus (10kg) | $10.90 (Kuwait) | $11.96 (Kuwait) |

| RSA | Grapefruit (15kg) | $15.17 (Kuwait) | $18.61 (Kuwait) |

| RSA | Grapefruit (15kg) | $11.72 – $13.60 (Dubai) | $10.90 – $14.50 (Dubai) |

Pome

Shipped YTD from South Africa and Chile

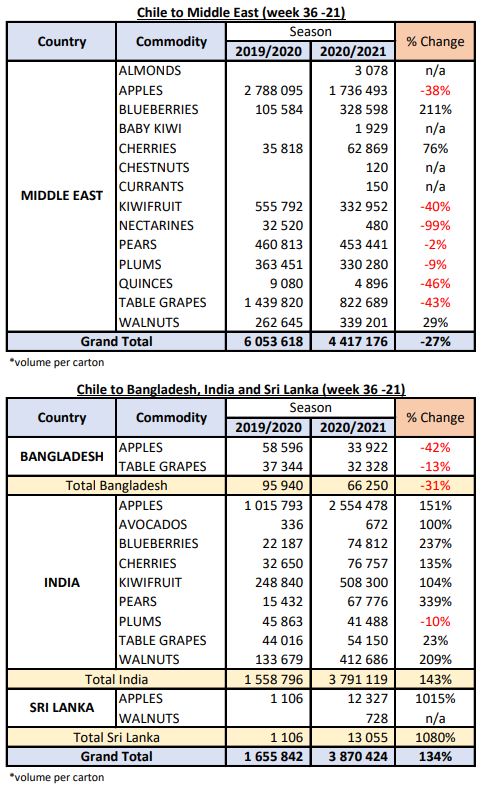

Apples from Chile to the Middle East – a decrease of 38% on cumulative volumes shipped to date compared to the 2020 season.

Apples from South Africa to the Middle East – an increase of 15% on cumulative volumes shipped to date compared to the 2020 season.

Pears from South Africa to the Middle East – a decrease of 3% on cumulative volumes shipped to date compared to the 2020 season.

Market update: The market continues to be stable and strong for apples and there is still a high demand for arrivals for pre-Hajj sales. Although the market remains stable on pears, the demand has dropped after Eid but will pick up again from week 26 and later in the season when CA volumes are available.

Market Prices

| Country | Commodity | Selling Prices week 21 | Selling Prices week 22 |

|---|---|---|---|

| Italy | Granny Smith (18kg) | $25.14 (Kuwait) | $23.60 (Kuwait) |

| Serbia | Granny Smith (18kg) | $25.14 (Kuwait) | $23.60 (Kuwait) |

| RSA | Granny Smith (18kg) | $22.77 (Kuwait) | |

| France | Granny Smith (18kg) | $25.26 (Kuwait) | |

| Italy / France | Granny Smith (18kg) | $21.75 – $22.00 (Dubai) | $24.45 – $24.70 (Dubai) |

| RSA | Granny Smith (18kg) | $16.35 (Dubai) | $17.71 – $19.07 (Dubai) |

| Italy/France | Golden Delicious (18kg) | $25.14 (Kuwait) | $21.94 (Kuwait) |

| Italy / France | Golden Delicious (18kg) | $24.45 – $24.70 (Dubai) | $24.45 – $24.70 (Dubai) |

| USA | Red Delicious (18kg) | $28.45 (Kuwait) | $27.76 (Kuwait) |

| Ukraine | Red Delicious (18kg) | $21.94 (Kuwait) | |

| China | Fuji (18kg) | $18.52 (Kuwait) | $18.52 (Kuwait) |

| RSA | Royal Gala – Econo packs (12kg) cnt 120- 135 | $18.45 – $18.70 (Dubai) | $18.45 – $18.70 (Dubai) |

| New Zealand | Royal Gala (18kg) | $25.14 (Kuwait) | $26.93 (Kuwait) |

| Serbia | Royal Gala (18kg) | $21.94 (Kuwait) | |

| Ukraine | Royal Gala (18kg) | $22.77 (Kuwait) | |

| Italy | Royal Gala (18kg) | $21.14 (Kuwait) | $23.60 (Kuwait) |

| RSA | Royal Gala (18kg) | $21.83 (Kuwait) | $21.94 (Kuwait) |

| New Zealand | Royal Gala (18kg) PR cnt 110-120 | $27.20 – $32.60 (Dubai) | $32.60 – $32.85 (Dubai) |

| Brazil | Royal Gala (18kg) cnt 113-125 | $24.45 – $24.70 (Dubai) | $23.65 – $23.85 (Dubai) |

| RSA | Royal Gala (18kg) cnt 120 – 135 | $23.16 – $26.25 (Dubai) | $24.45 – $26.25 (Dubai) |

| RSA | Royal Beaut (18kg) cnt 120-135 | $29.35 – $29.60 (Dubai) | $29.35 – $29.60 (Dubai) |

| Chile | Royal Gala (18kg) cnt 125 – 138 | $26.35 – $26.60 (Dubai) | $26.00 – $26.25 (Dubai) |

| RSA | Rosemarie/Forelle Pears (12kg) | $21.83 (Kuwait) | $16.95 (Kuwait) |

| RSA | Forelle Pears (12kg) | $15.80 – $16.55 (Dubai) | $13.62 – $16.00 (Dubai) |

| RSA | Vermont Pears (12kg) | $16.86 (Kuwait) | $12.79 (Kuwait) |

| RSA | Vermont Pears (12kg) | $12.53 – $15.25 (Dubai) | $11.72 – $13.85 (Dubai) |

| Chile | Coscia Pears (8kg) | $17.65 – $17.85 (Dubai) | $16.85 – $17.20 (Dubai) |

| Chile | Pears (8kg) | $15.21 (Kuwait) | $15.29 (Kuwait) |

| Spain | Pears (8kg) | $16.95 (Kuwait) |

Grape, Stone & Kiwi Fruit

Stone fruit

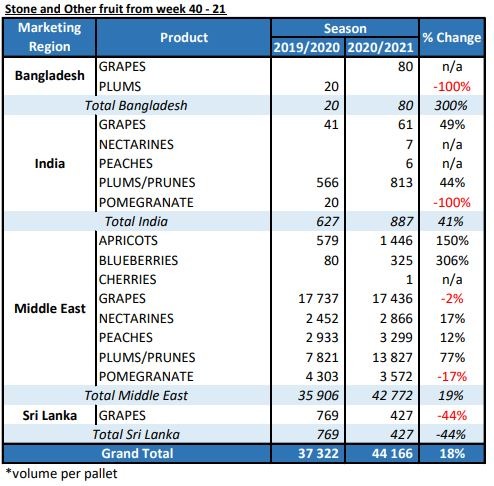

Continued market pressure and decline in price levels with the oversupply of plums in the GCC countries. This pressure is a result of the high volume of plums received from South Africa this season, together with volumes from Chile arriving in the market at the same time.

Shipped YTD from South Africa and Chile

Plums from South Africa to the Middle East – an increase of 77% on cumulative volumes shipped to date compared to the 2020 season.

Plums from Chile to the Middle East – a decrease of 9% on cumulative volumes shipped to date compared to the 2020 season.

Kiwi fruit

A continued increase in demand for Chilean Kiwi fruit across the globe with limited supply due to a decrease in production.

Kiwi fruit volumes shipped from Chile to the Middle East remain low at 40% less on cumulative volumes shipped to date compared to the 2020 season.

Market Prices

| Country | Commodity | Selling Prices week 21 | Selling Prices week 22 |

|---|---|---|---|

| Italy | Kiwi (3kg) | $7.36 – $8.70 (Dubai) | $8.00 (Dubai) |

| RSA | Plums (5 kg) – Black | $11.00 (Dubai) | $11.00 (Dubai) |

| RSA | Plums (5kg) | $10.24 (Kuwait) | $8.64 (Kuwait) |

| RSA | Plums (8kg) | $15.21 (Kuwait) | $16.95 (Kuwait) |

| Chile | Plums | $4.09 (Dubai) | |

| Chile | Red Globe (4.5kg) | $15.00- $15.25 (Dubai) | $12.75- $13.00 (Dubai) |

| Chile | Red Globe (8.2kg) | $26.65 – $26.85 (Dubai) | $25.00 – $25.25 (Dubai) |

India / Bangladesh

India

The Indian government has implemented an even stricter lockdown rule. The supply chain on fruits is full as lockdown rules are slowing down the sale of fruits to the final consumer. Apple market is still very good. All other imported fruits are struggling.

Bangladesh

Golden Delicious apples, as well as pears, seem to be the only contenders holding their own right now – although sales are slow, margins are still positive.

Other apple varieties have dropped into the red, with Egyptian oranges leading the price-plunge.

Lychees and mangoes are present in the market, however, with low volume and high prices, these tropicals are selling slowly with negative profits.

PPECB Statistics

Decofrut Statistics

Follow links to our social pages