Update on the market in the GCC countries

There is a lot of uncertainty in the market due to the ongoing problems in Red Sea, and this is affecting the trade into the Middle East. About two weeks ago price levels increased to high levels for most commodities when vessels were re-routed and the market was empty, however price levels dropped immediately as volumes started to arrive with volumes. This has affected the market for Lemons and Oranges due to high volumes arriving in the market all at once.

.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 109.75 BDT (Bangladeshi Taka) |

| 1.00 USD = 83.05 INR (Indian Rupees) |

| 1.00 USD = 18.98 ZAR (South African Rand) |

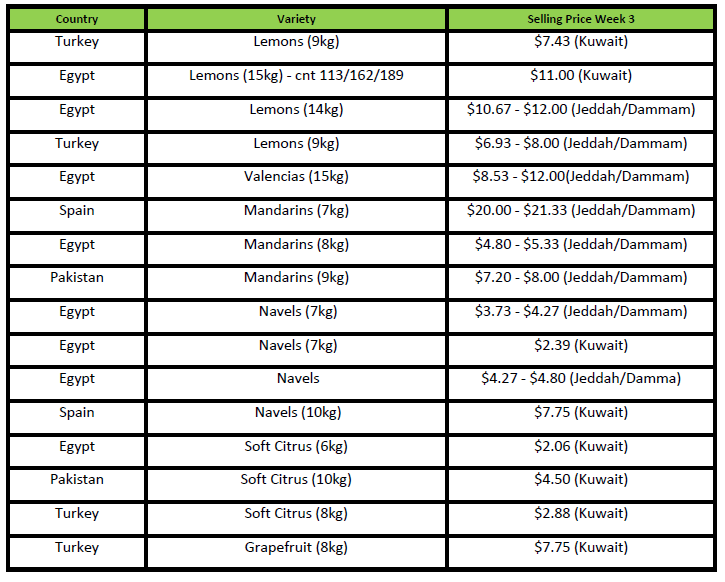

Citrus

Citrus fruit – In general

The packing of the very first early Lemons from the Northern areas in South Africa has started.

Market update

The Middle East market is full of Lemons from Egypt due to problems in port of not being able to get the stock out, as well as trucks. This caused a sharp increase in price levels, but as soon as stock was released into the market, price levels fell drastically. The market is supplied with Lemons from Egypt, Turkey, Iran, Syria, and China. The early Lemons from South Africa will compete with these countries in the market and at very competitive price levels. High prices for early Lemons from South Africa, will not be workable in the market.

Market Prices (Dubai, Kuwait and Jeddah)

Pome

Pome fruit

The longer transit time for Apples from Poland and Serbia is a problem for the GCC countries, as EU/Poland must go around Cape Point to get to the Middle East through the Red Sea. Maersk/Hapag/One shipping line will not go to Jeddah/KAP port or any other Red Sea ports. From Poland, shipping lines have increased freight levels to Dammam and Oman due to the longer transit times.

Market update

Although the market is relatively empty, there is high volumes of Apples on the water from Poland and Serbia. The market is worried about volumes arriving at the same time due to the ongoing issues in the Red Sea.

Market Prices (Dubai, Kuwait and Jeddah)

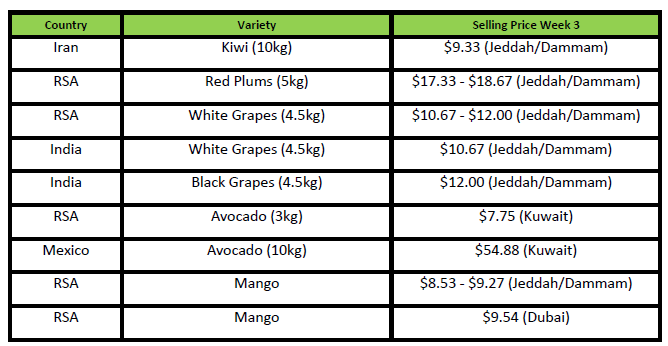

Grape, Stone, Kiwi Fruit

Grapes -South Africa

In the Northern Cape, packing is at the end of the season. The Berg and Hex River regions have started packing varieties such as Sweet Globe, Arra29, Starlight, Tawny and Sugraone.

Market update

The market is supplied with grapes from South Africa, India, and Peru.

Stone Fruit – South Africa

The Apricot/Peach and Plum export volumes are expected to be down by 33%; 4 % and 4 % respectively, compared to the previous season. Only a projected increase of 20% is predicted for nectarines exports compared to last season’s volumes. This increase is due to young orchards coming into production as well as new cultivars with higher yields.

Market update

Higher demand for Red plums in the Middle Market due to less supply available from South Africa. The market is supplied with Stone fruit from South Africa. Good quality Apricots from Australia in Qatar market and selling at $19,20 (10kg).

Cherries

Cherries from Argentina selling @ $71 (5kg) in Qatar.

Mangoes

The Tommy Atkins Mango variety has finished, and growers are starting to pack the Shelly, Kent and Keitt Mango varieties. Most growers are predicting that the Kent and Keitt varieties will be peaking on bigger sizes this season.

Market update

Mangoes from Kenya and South Africa are in the market, however the quality from Kenya is not good. Early season Mangoes from Yemen has started but quality is also not good, as Mangoes as still green. Volumes with good quality will only start from February to June with low prices for the Taimoor variety and consumers like the taste of mangoes from Yemen.

Kiwi fruit

There is Kiwi fruit from Iran in the market selling at $9.35 (10kg).

Market Prices (Dubai, Kuwait and Jeddah)

India / Bangladesh

India

No report.

Bangladesh

No report.

SA Statistics

Decofrut Statistics

Follow links to our social pages