Update on the GCC countries

The Middle East market is still experiencing pressure across all citrus and soft citrus categories, with sluggish movement observed—except for lemons, which are seeing an increase in demand. Apple sales remain slow, but pears are showing a more positive response.

The market is currently seeing a large supply of grapes from Egypt, offered at low prices, along with a high supply of stone fruit from Jordan and Syria.

Overall, the market is anticipated to improve after August 20, as locals return from vacation and school’s resume.

In General

Turkish supply across all commodities is expected to be down by approximately 30% this season due to frost experienced earlier in the year.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 121.51 BDT (Bangladeshi Taka) |

| 1.00 USD = 87.49 INR (Indian Rupees) |

| 1.00 USD = 17.70 ZAR (South African Rand) |

Citrus

Letsitele finished packing Midknight oranges. Fully transitioned to Valencia – smaller in size than Midknight. In Senwes Late Navel packing is completed. Only a few growers remain packing Late Mandarins. Midknight Valencia packing is ongoing and progressing well with weather conditions remaining favourable, supporting strong throughput.

In the Eastern Cape, lemon packing is nearly completed. European demand for lemons remains strong with record-high prices. Late mandarin packing is progressing steadily, with 4 weeks remaining. Cambria packing continues; peak sizes holding at count 72/88.

The Western Cape remains in full swing with Late Mandarins – peak size remains at count 1/2. The Western Cape area is now expected to continue for another 6 – 7 weeks on Mandarins. Cambria packing continues steadily, and Midknight packing is expected to commence within the next week. Rainy weather is causing some delays in picking.

Market update

Although Egyptian Valencias are nearly out of the market, movement remains slow for South African Valencias and all citrus commodities at the moment. Lemons, however, are beginning to show a more positive trend. While the soft citrus market is currently under pressure, it is expected to improve in the coming weeks with the arrival of late mandarins and a reduction in supply to the market.

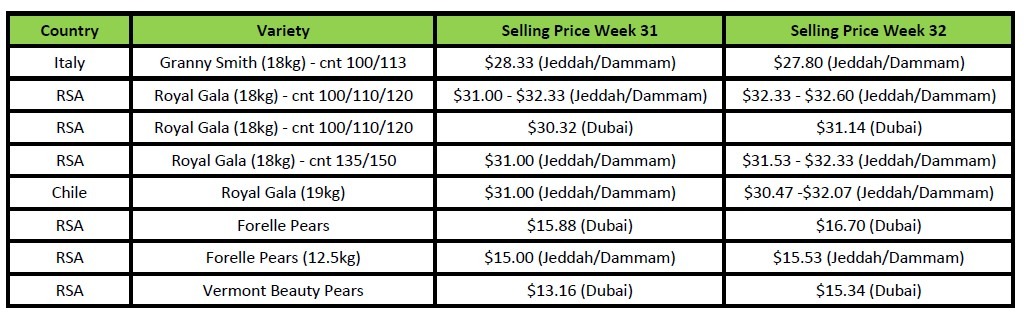

Market Prices (Dubai, Kuwait and Jeddah)

Pome

Pome fruit – South Africa

South Africa has about one week left for packing Royal Gala and Gala apple varieties, after which the season will conclude.

Packing of controlled atmosphere (CA) pears will remain limited over the next 2–3 weeks. Although volumes may increase slightly after that, they will stay low to prolong the CA season for as long as possible.

Market update

Despite steady demand for Royal Gala and Gala varieties, market movement remains slow.

The market is gradually preparing for the arrival of new season apple supplies from the Northern Hemisphere.

The pear market is beginning to show positive signs and is expected to improve further in the coming weeks, as shipments of controlled atmosphere (CA) pears from South Africa begin to decline.

Market Prices (Dubai, Kuwait and Jeddah)

Grape, Stone, Kiwi Fruit

Grapes – Market Update

No report.

Kiwi fruit

Currently, only Chilean kiwifruit is available in the market. The new season kiwifruit from Iran is expected to start in one week.

Pomegranates – Market update

No report.

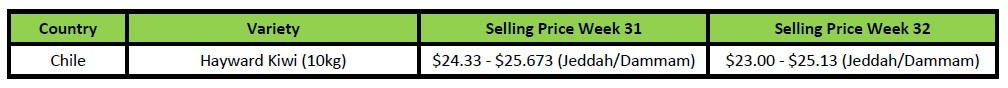

Market Prices (Dubai, Kuwait and Jeddah)

India / Bangladesh

India

Orange price sees slight increase

The price of South African Oranges have increased slightly as Egyptian oranges exit the market. Australian duties on citrus are 50% lower than SA duties and this affects the sale of SA citrus as well.

Bangladesh

South African Oranges in Hot Demand

Limited arrivals of South African oranges in Bangladesh have driven prices up sharply. High consumer demand and low supply are creating a premium market, with importers reporting strong sales. More shipments are expected to make arrival, but for now, it’s a high-margin, low-volume game.

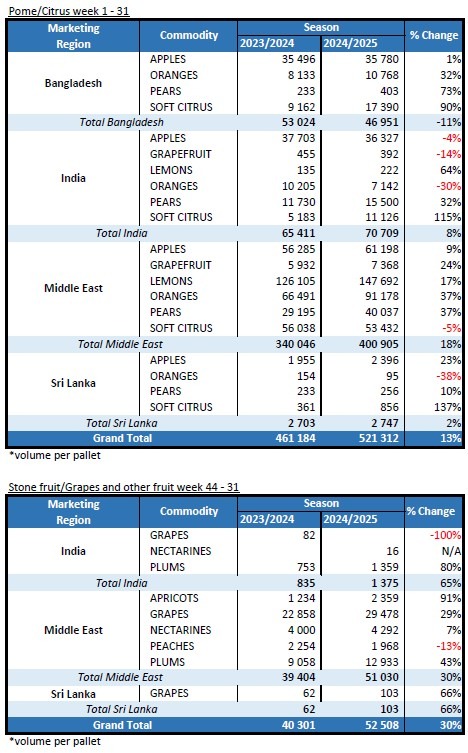

SA Statistics

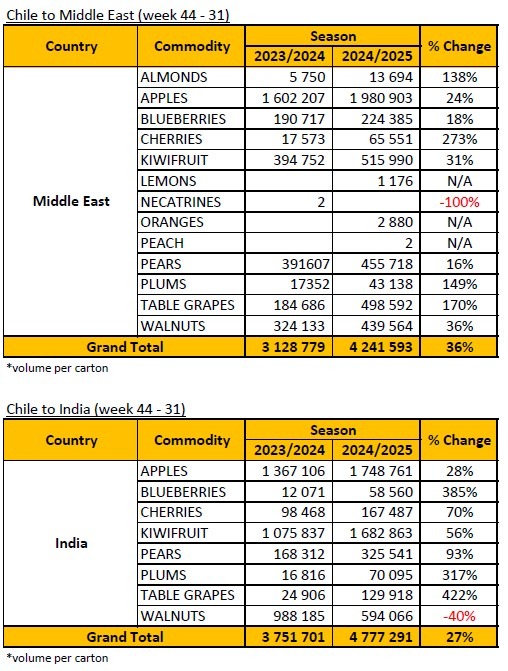

Decofrut Statistics

Follow links to our social pages