The export of citrus fruit through Maputo port this season, has been the priority of the South African Citrus Growers Association due to continued delays and congestion in Durban port. The progress has been very positive, with two main container line services calling Maputo. These include shipping to the Middle East, India, and Singapore. In addition, there is also an option to ship citrus to Bangladesh from Maputo.

Little change to the Middle market that continues to be under tremendous pressure this season with poor and unstable market conditions, slow sales rates and price levels on most commodities and especially citrus fruits. The demand has however picked up for the late season pears from South Africa.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 95.00 BDT (Bangladeshi Taka) |

| 1.00 USD = 79.74 INR (Indian Rupees) |

| 1.00 USD = 16.90 ZAR (South African Rand) |

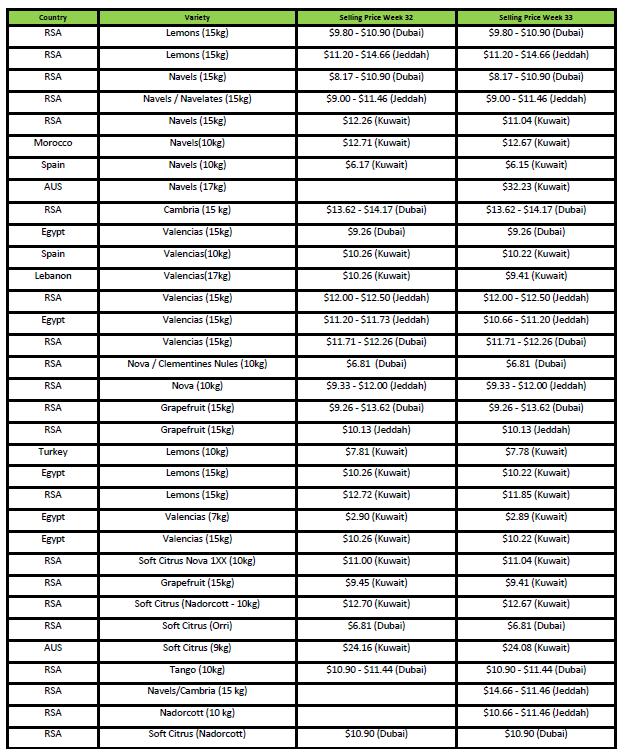

Citrus

South Africa is at the tail-end of the lemon season, with only four weeks left of packing. There is about ten weeks left on the packing of oranges from South Africa, however 3-5 weeks of packing in the Northern areas and later packing will be from the Western Cape area.

There is an ongoing threat to the South African citrus industry resulting from the new EU False Codling Moth (FCM) regulations. The new regulations that was announced in June and implemented in July, is causing a disruption to the normal export of South African oranges to customers in Europe, one of the most important markets for the citrus industry during the peak of the season. To date, this has cost citrus growers many losses.

Market update

The Middle East market remains under pressure for citrus fruit, and this is contributed to unstable market and the higher volumes of oranges being shipped to the GCC countries. There will however be an increase in the volume of citrus fruits shipped to Qatar for the remainder of the season, in preparation for the FIFA World cup to be hosted in the country from November to December this year.

There has been an overall increase in the volume of citrus shipped YTD from South Africa to the Middle East market by the end of week 32 compared to the same period last season. Exported volumes indicate 12% increase on oranges, lemons are up 29%, and soft citrus by 2%.

Market Prices (Dubai, Kuwait and Jeddah)

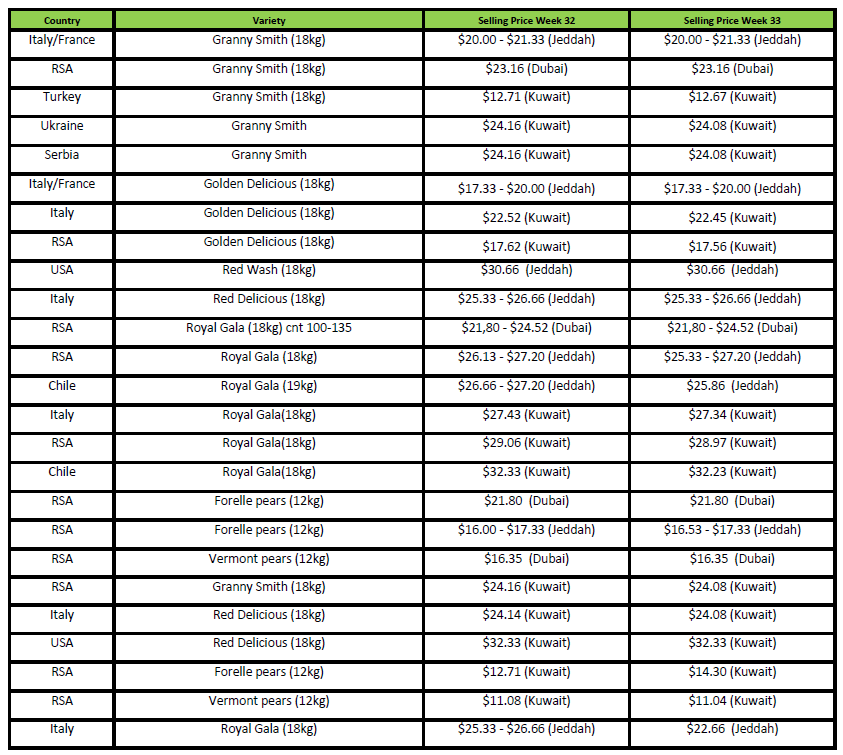

Pome

There has been no change in the combined apple shipments from both Chile and South Africa to the Middle East that is still 5% down compared to the same time last season. South Africa is at the end of the season and packing of apples.

Market update

It is very difficult to ship the last of the season’s apples from South Africa to the Middle East due to these apples that will compete in the market with the new season apples from Spain, Italy, Turkey, Greece, and Serbia and at low price levels. The market prefers the start of the new season apples. There has been an increase in the demand for late season pears from South Africa due to limited availability from South Africa.

Market Prices (Dubai, Kuwait and Jeddah)

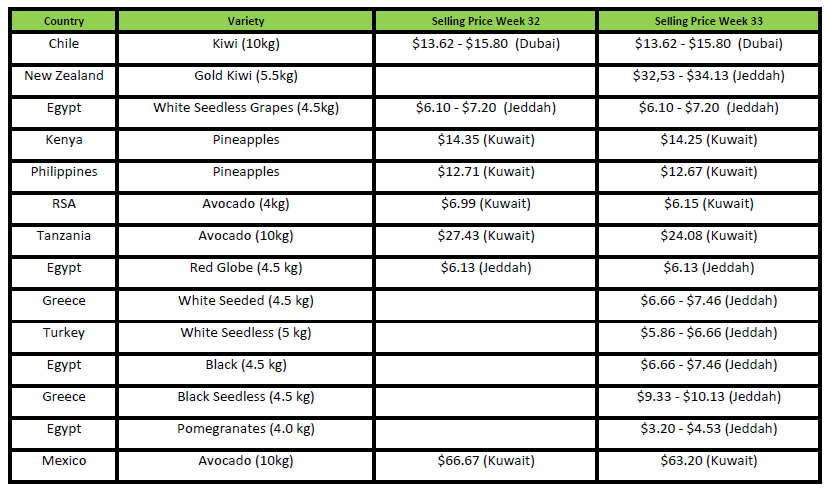

Grape, Stone & Kiwi Fruit

Update on Kiwi Fruit and a market update in the GCC countries

Chile has exported just over 88,000 metric tons of kiwifruit, a 12% decrease from the same period last year. However, this decrease has not affected the Middle East market that continues to be under pressure, with low sales rate and price levels as Chilean kiwi fruit competes with Iranian Kiwi fruit at low price levels in the market.

Market Prices (Dubai, Kuwait and Jeddah)

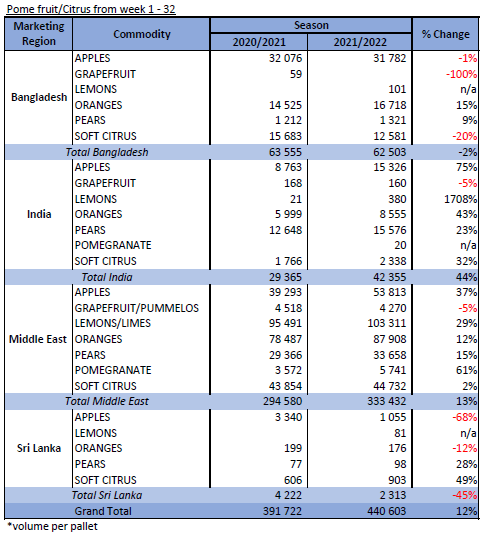

India / Bangladesh

India

Just like the Middle East South Africa has shipped too many oranges to India and the market will crash. Pear market is empty and short, just a little bit of bad quality old stock left over. Apple market struggling and easy peelers maintaining good pricing.

Bangladesh

South Africa have increased the volumes of Oranges shipped to Bangladesh. This has already affected the prices that customers would like to pay. Easy peelers doing well and customers are asking for pears again but only class 1. Easy peelers pricing for new orders has dropped.

PPECB Statistics

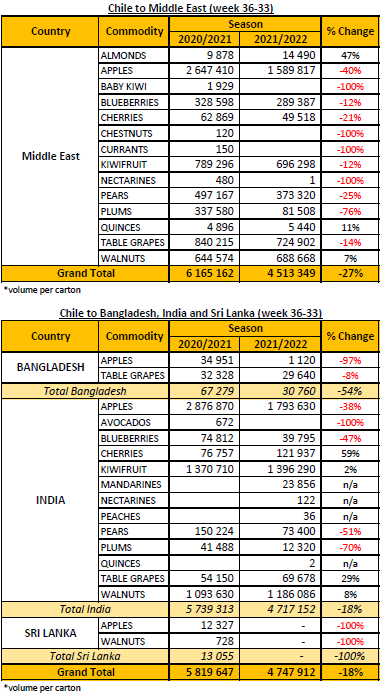

Decofrut Statistics

Follow links to our social pages