Update on the GCC countries

Citrus prices have shown signs of improvement, supported by the anticipated reopening of schools on 25 August and a decline in the availability of local Jordanian fruit.

Mandarins is expected to improve in the coming weeks, supported by lower current volumes and limited varieties available in the market.

Apple prices continue to show a downward trend, particularly for end-of-season fruit from South Africa and Chile, as the market anticipates the arrival of new-season European apples. In contrast, pears are experiencing a positive shift, with both sales activity and pricing showing week-on-week improvement.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 121.79 BDT (Bangladeshi Taka) |

| 1.00 USD = 87.51 INR (Indian Rupees) |

| 1.00 USD = 17.67 ZAR (South African Rand) |

Citrus

Letsitele fully transitioned to Valencia oranges, which are forecasted to be smaller than seedless varieties. 3–4 more weeks of strong, high-quality Valencia packing is expected. In Senwes final orchards of lemons, Late Navels, and Late Mandarins are being packed and the region is wrapping up.

In the Eastern Cape only limited lemon volumes remain; some growers have finished. European demand for lemons remains high. Late Mandarins are still being packed, with +- 3 weeks left. Cambria and Witkrans packing continues, with good fruit quality being reported. Valencia varieties are peaking on count 88/105.

The Western Cape packing of Late Mandarins (mainly Nadorcott and Tango) is in full swing. Good eating quality with acids still around 1.00 and Brix above 13. Cambria packing remains steady, with good colour observed. Midknight oranges will start this week (Week 34).

Market update

Overall citrus prices for both oranges and lemons recorded a slight improvement this week, supported by increased local demand as consumers return from summer vacations with the reopening of schools.

While Egyptian Valencias remain available in the market, volumes are limited, and no additional shipments are expected from Egypt.

The new Egyptian lemon season has yet to commence and is expected to begin in the first week of September. Turkish lemons are anticipated to enter the market between late October and early November. However, overall volumes from Turkey are projected to be lower this season due to frost damage earlier in the year that impacted the crop.

Market Prices (Dubai, Kuwait and Jeddah)

Pome

Pome fruit – South Africa

Controlled atmosphere (CA) pear packing continues at limited volumes.

Market update

A slight decline in the prices of both Chilean and South African Royal Gala/Gala apples was observed this week. The downward adjustment is attributed to growing market uncertainty surrounding the expected pricing levels for the upcoming shipments of European apples. In contrast, pear sales continue to improve week by week.

Market Prices (Dubai, Kuwait and Jeddah)

Grape, Stone, Kiwi Fruit

Grapes – Market Update

No report.

Kiwi fruit

Currently, the market is solely supplied with Chilean kiwifruit, as the new Iranian season is yet to commence. Market prices for Chilean Kiwi fruit remain on the lower side and volume is limited.

Pomegranates – Market update

No report.

Market Prices (Dubai, Kuwait and Jeddah)

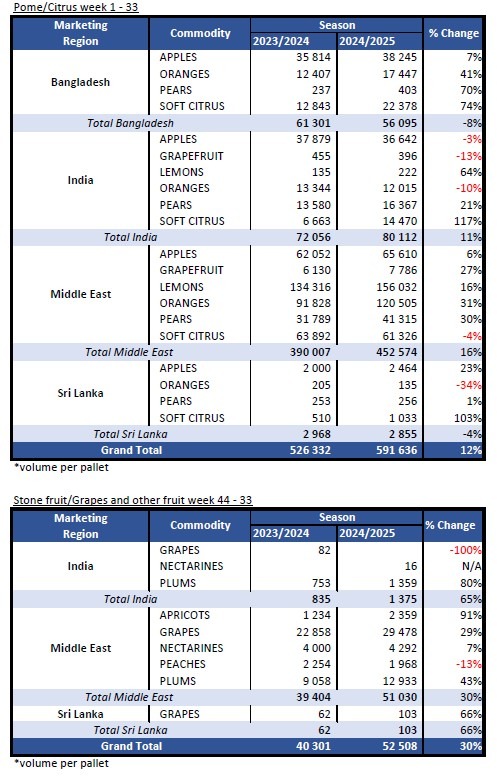

India / Bangladesh

India

Storms and floods

Storms and floods have stopped all sales in Mumbai this week. Flooding has affected the movement of fruit to customers. Mandarin prices have dropped again this week in the market as well as prices offered by SA exporters.

Bangladesh

Apple Feedback

The shipment of Royal Gala/Gala from South Africa has ended. Luckily, the market is still performing well on Royal Gala/Gala sales from South Africa, and importers can recover some of the losses that they made earlier in the year. Demand for Golden Delicious is picking up.

SA Statistics

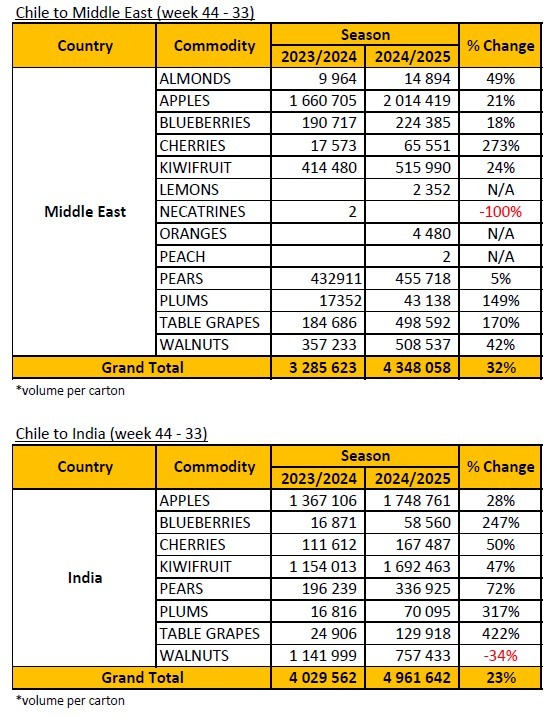

Decofrut Statistics

Follow links to our social pages