Update on the GCC countries

The market for Cambria oranges remains stable, though movement is slower as a result of the higher volumes currently available.

The market is under pressure on Valencia oranges due to huge weekly shipments from RSA over the past 3 weeks and current stocks in the markets that are selling slowly.

Nadorcott, lemons, and pears are performing well, with reduced availability supporting stronger demand.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 121.45 BDT (Bangladeshi Taka) |

| 1.00 USD = 88.27 INR (Indian Rupees) |

| 1.00 USD = 17.36 ZAR (South African Rand) |

Citrus

In Letsitele Late Valencia orange packing is now in the final stretch of packing. Most growers expect to complete harvest by the end of the week or early next, weather permitting. Packing facilities are beginning to scale down operations as volumes taper off. Fruit quality remains good, with steady internal quality and acceptable sizing. In Senwes the season remains closed with no further activity. Growers shifting focus to orchard prep and maintenance for the next cycle.

In the Eastern Cape lemons volumes continue to decrease, with only residual fruit being packed for late orders or niche markets. Late Mandarins will continue with approximately 1 week remaining. Packing slowing as fruit availability and quality begin to drop. Last volumes of Cambria and Witkrans being packed, fruit quality remains high, with good colour and firmness. Valencia packing in full swing, sizing continues to peak on count 72/88, with export quality holding strong.

In the Western Cape Late Mandarins (mainly Nadorcott and Tango) is still being packed. Internal quality remains strong as well as sugar-acid balance. Expected to continue into the following week for some growers. Packing of Midknight oranges is increasing steadily. Sizing still dominated by count 64/72, with some larger sizes beginning to show. Currently around 40 – 45% Valencia oranges has been packed, showing a good uptick from the previous week. Fruit flow expected to increase into week 38, with improved colour and maturity.

Market update

Mandarin and lemon prices strengthened this week, supported by reduced availability. The first arrivals of Egyptian lemons have entered the market, though demand remains focused on South African lemons, as the preferred consumer variety from Egypt are not yet available.

As the South African season nears its end, attention is on the high volumes of Valencia oranges still en route, which will create pressure on market prices.

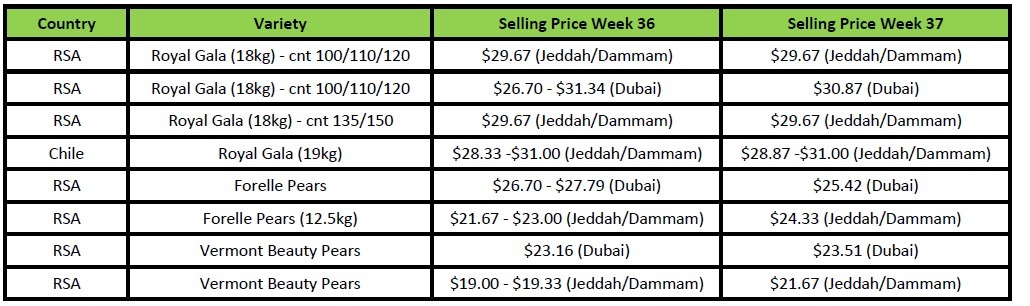

Market Prices (Dubai, Kuwait and Jeddah)

Pome

Pome fruit – South Africa

Controlled Atmosphere (CA) pear packing is progressing in limited volumes, with suppliers carefully managing remaining stocks to extend the season.

Market update

Apples are currently available from Serbia, Ukraine, France, and Italy. With additional arrivals expected, the market is anticipated to be well supplied by early October.

South African pears are continuing to perform well, in line with market expectations.

Market Prices (Dubai, Kuwait and Jeddah)

Grape, Stone, Kiwi Fruit

Grapes – Market Update

No report.

Kiwi fruit

Kiwi fruit availability remains limited following the end of the Chilean season. Despite limited supply, prices have dropped due to weaker quality typically seen at the end of the season.

Supply from Iran has not yet started.

Pomegranates – Market update

No report.

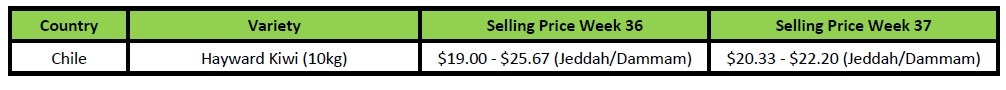

Market Prices (Dubai, Kuwait and Jeddah)

India / Bangladesh

India

Citrus prices drop

Valencias market selling prices dropped by $3.50 per carton in one week and more drops are expected. Soft citrus holding up OK. We definitely see a shift away from Oranges to Easypeelers in the market.

Bangladesh

Citrus Update

Valencia packing up north will finish next week.

In the Western Cape, Mandarins will still be packed for about two more weeks.

Large volumes of citrus fruit have been shipped from South Africa to Bangladesh.

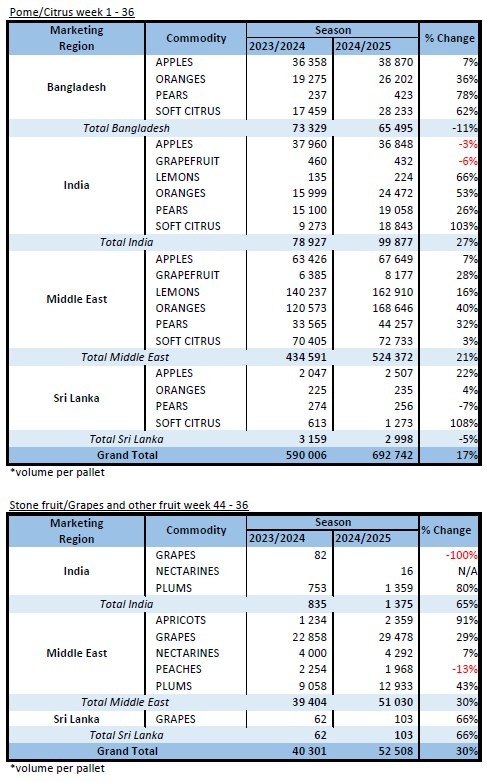

SA Statistics

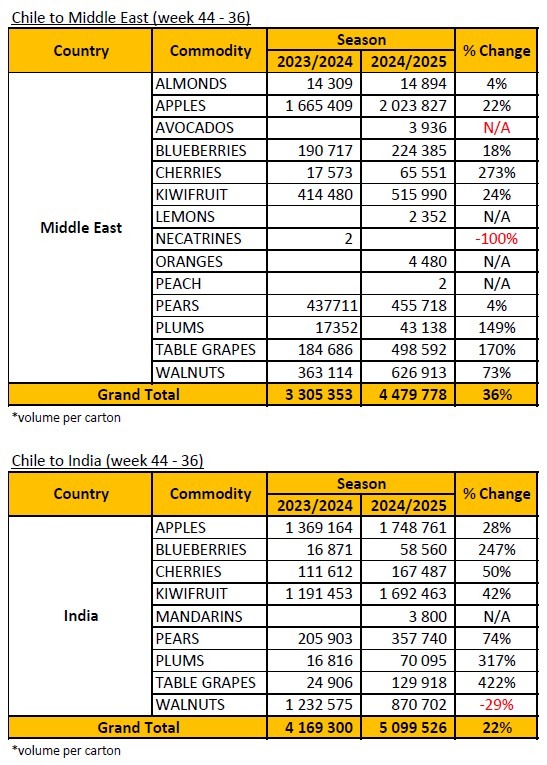

Decofrut Statistics

Follow links to our social pages