Update on the GCC countries

The overall market remains under pressure for most commodities. South African oranges have not performed as expected and will face significant competition as new-season oranges from Egypt begin arriving in early December.

The cherry market is currently oversupplied, with cherries from Argentina, Australia, Chile, and South Africa.

Pears from South Africa have only just started to gain traction in the market and are expected to perform steadily week by week.

Grapes from Peru are performing well due to the supply shortage, as are Red Delicious apples from the USA.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 119.41 BDT (Bangladeshi Taka) |

| 1.00 USD = 84.50 INR (Indian Rupees) |

| 1.00 USD = 18.05 ZAR (South African Rand) |

Citrus

Citrus fruit – South Africa

No report.

Market update

There is minimal availability of Navelates from South Africa remaining in the market, with a slight price increase observed for Cambria oranges. However, prices for South African Valencias have declined and are yet to recover. The market is expected to face competition as the first shipments of Egyptian oranges are anticipated to arrive starting from the 1st of December.

Mandarin supplies from Australia and Peru have come to an end. Shipments from Egypt and Morocco have just started reaching the Middle East market. While Egyptian mandarins are of lower quality and priced at $5.85–$6.50 per 8kg, Moroccan mandarins, with a higher quality, are reaching higher prices of $17.35–$18.65 per 8–10kg.

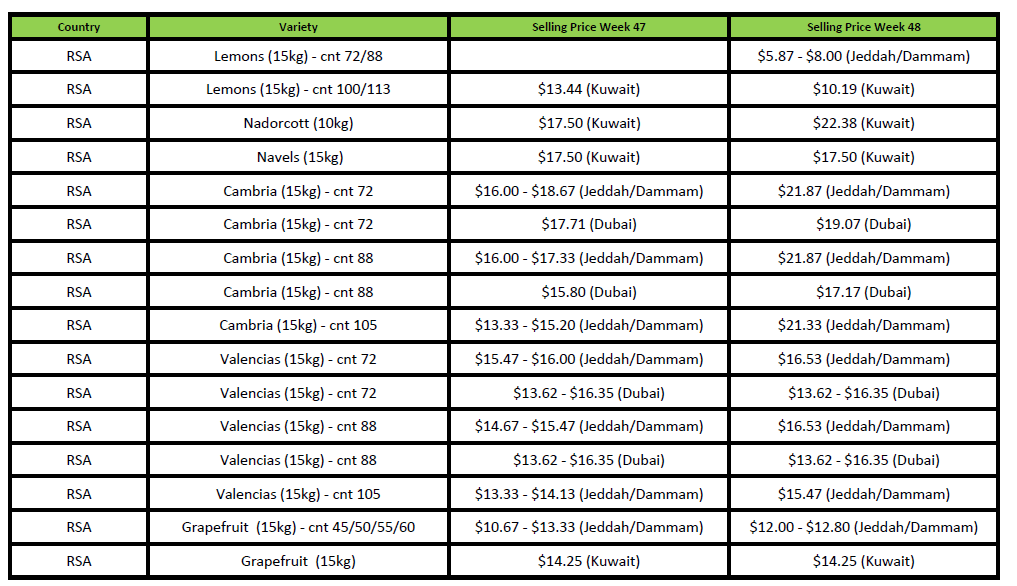

Market Prices (Dubai, Kuwait and Jeddah)

Pome

Pome fruit

South Africa

No report.

Market update

Royal Gala apples in the Middle East market are priced between $23.50–$24.50 for imports from Italy and France, while apples from Ukraine and Serbia are priced slightly lower, between $21.85–$22.65. In contrast, Red Delicious apples from the USA are performing well, with prices ranging from $29.35–$30.65.

The price of South African Forelle and Vermont Beauty pears has risen to between $25.35–$28.55 as the weekly volume supply continues to decrease.

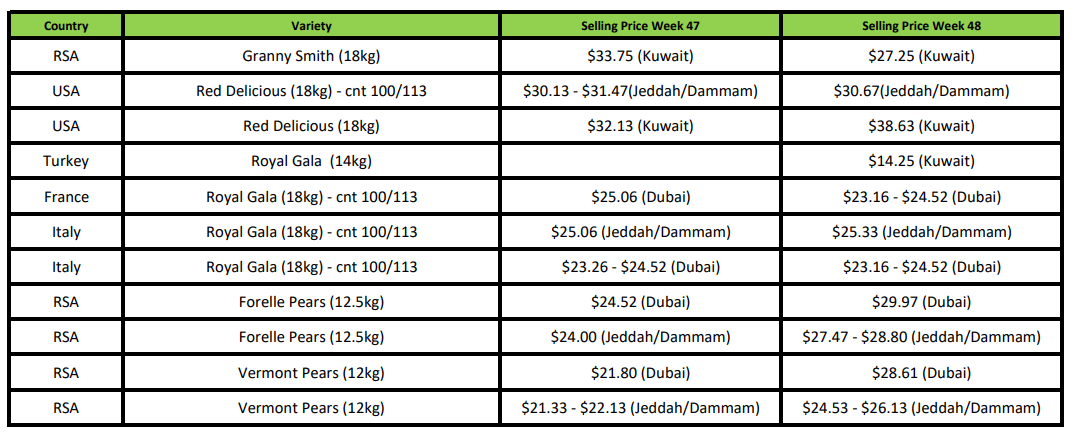

Market Prices (Dubai, Kuwait and Jeddah)

Grape, Stone, Kiwi Fruit

Grapes -South Africa

Packing of the Early Sweet and Prime white seedless varieties is underway in the Northern Cape.

The UK and European markets are performing very well, and volumes will be focused on these regions to ensure pre-Christmas arrivals.

Market update

Grapes are currently available from Peru, specifically the Sweet Globe white variety, which is selling at premium price levels of $41.35–$42.65 per 8.2kg due to a supply shortage. India has also started supplying the market; however, the taste quality is not good. Despite this, prices for Indian grapes remain high due to the ongoing shortage. This situation is expected to improve in the coming weeks as shipments from Namibia and South Africa begin to arrive in the market.

Stone Fruit -South Africa

Currently, there are three nectarine varieties available, but the sizing is inconsistent. Peaches have finished, with new varieties expected to begin in the next 7-10 days. Apricots have started, but the season is off to a slow start with low volumes. Similarly, plums have begun, but their availability is limited, and the sizing is quite small.

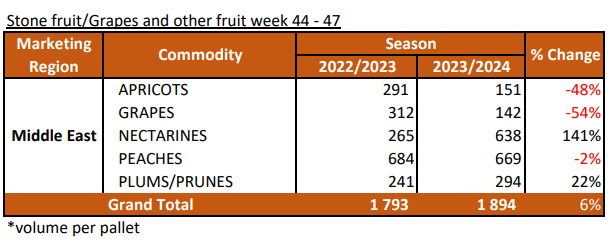

Market update

The first sea shipments of stone fruit from South Africa, including nectarines, have started arriving and are priced between $9.35–$10.65 per 2.5kg. Meanwhile, apricots via airfreight are selling at higher prices, ranging from $25.35–$26.65 per 4.75kg. Australian peaches and nectarines are still available in the market, but their prices have dropped for 10kg cartons.

Kiwi fruit – Market update

The market is currently being supplied with kiwifruit from Iran and gold kiwifruit from Italy.

Cherries

The South African cherry season is in full swing, driven by significant growth in cherry tree plantings, which has created opportunities for substantial market expansion. Currently, around 40% of South Africa’s cherry production supplies the local market. However, with the establishment of new orchards and increasing yields, the country is focusing on expanding exports to key markets such as the United Kingdom, Europe, the Far East, and the Middle East. Additionally, South Africa aims to secure market access to China by 2027.

In the Middle East market, South Africa is competing with major suppliers, including Argentina, Australia, and Chile, offering cherries at highly competitive price levels.

Market update

Cherries from Australia, Argentina, Chile, and South Africa are currently available in the Middle East market. However, the market is oversupplied, resulting in significant price competition and a price war across various price levels.

Mangoes -South Africa

The mango export season has kicked off from South Africa in the areas with early production. Hoedspruit, starting exports one to two weeks later.

Early production areas often focus on supplying high-value local markets, which limits the volume available for export in the initial weeks.

Market update

The Egyptian mango season has come to an end, with the market now being supplied by competitively priced mangoes from Kenya. At the same time, the Middle East has begun receiving mango offers from Peru through both airfreight and sea freight. Furthermore, the arrival of new-season mangoes from South Africa in the coming weeks, adding further diversity to the market.

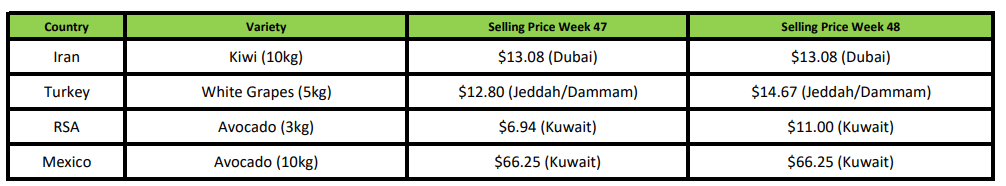

Market Prices (Dubai, Kuwait and Jeddah)

India / Bangladesh

India

No report.

.

Bangladesh

No report.

SA Statistics

Decofrut Statistics

Follow links to our social pages