In South Africa, Cape Town port is wind bound and the port is currently closed until further notice. There is congestion at the port as a result of the influx of trucks waiting to get into the ports terminal once it resumes operations.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 84.73 BDT (Bangladeshi Taka) |

| 1.00 USD = 73.73 INR (Indian Rupees) |

| 1.00 USD = 14.96 ZAR (South African Rand) |

Citrus

The on-going rain in the Northern areas continue to hamper the packing of lemons. Some Producers decided to rather pack these lemons for the local market instead of exporting them. The largest citrus producing area, Senwes, will peak on larger lemons this season (size 75-88-100).

Market update: The GCC countries are currently being supplied with lemons from China, Egypt and Turkey and the market remains stable . Early Lemons (limited volumes) have been shipped from South Africa but have not made arrival yet in the GCC countries.

Market Prices

| Country | Variety | Selling Prices week 7 | Selling Prices week 8 |

|---|---|---|---|

| Lebanon | Navels (6kg) | $2.78 (Kuwait) | $1.62 (Kuwait) |

| Egypt | Navels (7kg) | $2.78 (Kuwait) | $2.45 (Kuwait) |

| Egypt | Navels (7.5kg) | $4.53 – $5.07 (Jeddah) | $4.53 – $5.07 (Jeddah) |

| Syria | Navels (7kg) | $1.95 (Kuwait) | $1.62 (Kuwait) |

| Spain | Navels (10kg) | $8.56 (Kuwait) | |

| Lebanon | Navels (14kg) | $8.56 (Kuwait) | $6.08 (Kuwait) |

| Syria | Navels (14kg) | $5.25 (Kuwait) | |

| Egypt | Navels (15kg) | $8.56 (Kuwait) | $7.73 (Kuwait) |

| Egypt | Navels | $8.99 – $9.26 (Dubai) | $9.26 – $9.81 (Dubai) |

| Turkey | Lemons (5kg) | $2.78 (Kuwait) | $1.95 (Kuwait) |

| Turkey | Lemons (10kg) | $6.91 (Kuwait) | $6.91 (Kuwait) |

| China | Lemons (15kg) cnt 100-113 | $15.20 – $16.00 (Jeddah) | $15.20 – $16.00 (Jeddah) |

| Turkey | Lemons (15kg) | $16.35 (Dubai) | $16.35 – $16.89 (Dubai) |

| Turkey | Lemons (15kg) | $11.86 (Kuwait) | $11.86 (Kuwait) |

| Egypt | Lemons (15kg) | $11.03 (Kuwait) | $12.68 (Kuwait) |

| Egypt | Lemons (15kg) | $12.26 – $12.80 (Dubai) | $12.26 (Dubai) |

| Egypt | Lemons (15kg) cnt100/113/125/138 | $12.80 – $14.67 (Jeddah) | $12.80 – $14.67 (Jeddah) |

| Lebanon | Valencias (5kg) | $1.30 (Kuwait) | $1.96 (Kuwait) |

| Egypt | Valencias (7.5kg) | $1.95 (Kuwait) | $1.95 (Kuwait) |

| Egypt | Valencias (15kg) | $6.03 (Kuwait) | $7.73 (Kuwait) |

| Egypt | Valencias (15kg) cnt 72-100 | $6.13 – $9.33 (Jeddah) | $5.33 – $8.00 (Jeddah) |

| Egypt | Valencias | $7.63 – $8.17 (Dubai) | $8.17 – $8.72 (Dubai) |

| Lebanon | Soft Citrus (5kg) – Nova | $2.28 (Kuwait) | $1.95 (Kuwait) |

| Syria | Soft Citrus (6kg) | $1.95 (Kuwait) | $1.95 (Kuwait) |

| Egypt | Soft Citrus (8kg) | $3.60 (Kuwait) | $3.27 (Kuwait) |

| Australia | Soft Citrus (8kg) | $6.08 (Kuwait) | $6.08 (Kuwait) |

| Morocco | Mandarin (10kg) | $14.93 – $16.00 (Jeddah) | $14.93 – $16.00 (Jeddah) |

| Morocco | Soft Citrus (10kg) | $5.25 (Kuwait) | $10.21 (Kuwait) |

| Pakistan | Soft Citrus (10kg) | $4.43 (Kuwait) | $5.25 (Kuwait) |

| Pakistan | Mandarin (10kg) | $5.33 – $5.60 (Jeddah) | $5.33 – $5.60 (Jeddah) |

| Pakistan | Mandarin | $5.45 – $6.26 (Dubai) | $5.99 – $6.54 (Dubai) |

| Turkey | Soft Citrus (10kg) | $6.91 (Kuwait) | $6.91 (Kuwait) |

| Spain | Mandarin (10kg) | $12.80 – $13.33 (Jeddah) | $12.80 – $13.33 (Jeddah) |

| Turkey | Grapefruit (7kg) | $2.78 (Kuwait) | $3.60 (Kuwait) |

| Turkey | Grapefruit (15kg) | $11.44 (Dubai) | $7.36 (Dubai) |

| Turkey | Grapefruit (15kg) | $8.56 (Kuwait) | $11.86 (Kuwait) |

Pome

Upward trend in market prices for Red apples from USA in the GCC countries. Poland is also starting to gain recognition in the market.

In general, the market remains stable on apples on demand and price levels.

Pome fruit – RSA : Apple inspections passed for export YTD by the end of week 7 was up by 20% on all varieties currently being packed, while pears volumes are up by 2% compared to the same period last season. The Western Cape is at the tail-end of the summer pears season.

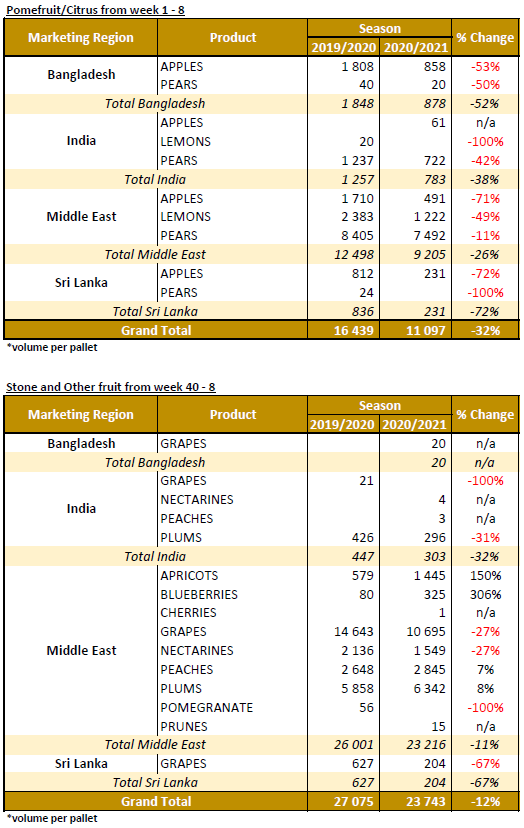

Shipped YTD from South Africa

Apples – Middle East – decrease of 71% on cumulative volumes shipped to date compared to 2020 season.

Pears – Middle East – decrease of 11% on cumulative volumes shipped to date compared to 2020 season.

In General: Southern Hemisphere apple production is expected to increase by 6% compared to last season according to the World Apple and Pear Association (WAPA).

Export volumes are expected to stabilise for Chile, increase of 4% in South Africa and a -7% decrease in New Zealand. Chile remains the largest apple producer in 2021, followed by Brazil in second place and then followed by South Africa, Argentina, New Zealand and Australia. Gala remains the main variety representing 39%

The forecast on pear exports suggests an increase of 6% compared to last season with a 12% increase from Argentina, 2% South Africa and a -3% decrease from Chile.

Market Prices

| Country | Variety | Selling Prices week 7 | Selling Prices week 8 |

|---|---|---|---|

| Italy | Granny Smith (18kg) | $30.02 (Kuwait) | $31.67 (Kuwait) |

| Serbia | Granny Smith (18kg) | $28.37 (Kuwait) | $31.67 (Kuwait) |

| France | Granny Smith (18kg) | $28.37 (Kuwait) | $31.67 (Kuwait) |

| Turkey | Granny Smith (18kg) | $28.67 (Kuwait) | |

| Italy / France | Granny Smith (18kg) | $34.00- $34.25 (Dubai) | $36.70- $36.95 (Dubai) |

| Italy / France | Golden Delicious (18kg) | $24.45- $24.70 (Dubai) | $32.00- $32.25 (Dubai) |

| France | Golden Delicious (18kg) | $23.42 (Kuwait) | $23.42 (Kuwait) |

| USA | Red Delicious – PR (18kg) cnt 100-113 | $28.00 (Jeddah) | $28.00 (Jeddah) |

| USA | Red Delicious – XF (18kg) cnt 100-113 | $24.53 – $25.33 (Jeddah) | $24.53 – $25.33 (Jeddah) |

| USA | Red Delicious (18kg) | $21.76 (Kuwait) | $23.42 (Kuwait) |

| Italy | Red Delicious (18kg) | $20.11 (Kuwait) | |

| Turkey | Fuji (18kg) | $20.94 (Kuwait) | $13.51 (Kuwait) |

| Ukraine | Royal Gala (18kg) | $23.42 (Kuwait) | $22.59 (Kuwait) |

| USA | Royal Gala (18kg) | $31.50- $31.75 (Dubai) | $33.00- $33.25 (Dubai) |

| Italy | Royal Gala (18kg) | $25.07 (Kuwait) | $23.42 (Kuwait) |

| Italy / France | Royal Gala (18kg) | $23.98 – $25.61 (Dubai) | $25.61 – $32.25 (Dubai) |

| Italy | Royal Gala (18kg) cnt 100 – 138 | $24.53- $26.13 (Jeddah) | $24.27- $25.33 (Jeddah) |

| USA | Royal Gala (18kg) | $26.72 (Kuwait) | $26.72 (Kuwait) |

| Serbia | Royal Gala (18kg) cnt 100 – 125 | $24.00 – $25.33 (Jeddah) | $23.47 – $24.80 (Jeddah) |

| Serbia | Royal Gala (18kg) cnt 100 – 113 | $25.75 – $26.00 (Dubai) | |

| New Zealand | Royal Gala (18kg) | $26.72 (Kuwait) | $25.89 (Kuwait) |

| Serbia | Royal Gala (19kg) | $21.76 (Kuwait) | $21.76 (Kuwait) |

| Turkey | Pears (4kg) | $1.95 (Kuwait) | $2.78 (Kuwait) |

| Spain | Koshi Pears (8kg) | $11.86 (Kuwait) | $15.16 (Kuwait) |

| USA | Pears (10kg) | $13.68 (Kuwait) | |

| USA | D’Anjou (10kg) | $20.40 – $20.65 (Dubai) | $20.40 – $20.65 (Dubai) |

| RSA | Williams BC’s Pears (12kg) | $14.00 – $14.25 (Dubai) | |

| RSA | Rosemarie Pears (12kg) cnt 90/96/112/120 | $16.00 – $18.67 (Jeddah) | |

| RSA | Rosemarie Pears (12kg) | $25.07 (Kuwait) | |

| RSA | Rosemarie Pears (12kg) | $21.75 – $22.00 (Dubai) | |

| RSA | Sempre Pears (12kg) cnt 90/96/112/120 | $13.33 – $16.00 (Jeddah) | |

| RSA | Sempre Pears (12kg) | $20.11 (Kuwait) | |

| RSA | Sempre Pears (12kg) | $18.50 – $18.75 (Dubai) |

Grape, Stone & Kiwi Fruit

Grapes

The Hex River is at the tail-end of production. Crimson Red Seedless grapes will be packed for another 4-5 weeks and Red globe 2 weeks. The packing of Larochelle Black seeded grapes has started with limited volumes being packed on this variety .

Shipped YTD – South Africa

Grapes – Middle East – decrease of 27% on cumulative volumes shipped to date compared to 2020 season.

The price of White grapes from South Africa in Saudi Arabia continues to hold at high price levels.

In General: In Chile, after the heavy rainfall it is estimated that losses will be between 70-80% on white grapes from Chile’s central to Southern regions and 30% on the Red grape harvest.

Stone fruit

Plums – RSA: Plum inspections passed for export YTD by the end of week 7 was up by 22% compared to the same period last season.

Shipped YTD from South Africa

Plums – Middle East – No change on cumulative volumes (+3%) shipped to date compared to the 2020 season. The market in Dubai remains sluggish on red plums, however the market has picked up for Yellow plums.

Market Prices

| Country | Variety | Selling Prices week 7 | Selling Prices week 8 |

|---|---|---|---|

| Italy | Kiwi (3kg) | $5.99 – $6.81 (Dubai) | $5.99 – $7.35 (Dubai) |

| Iran | Kiwi (10kg) | $5.45 (Dubai) | $7.00 (Dubai) |

| RSA | Plums ( 5 kg) – Red and Black | $9.81 – $10.35 (Dubai) | $5.45 – $8.00 (Dubai) |

| RSA | Plums (5kg) | $8.56 (Kuwait) | $6.91 (Kuwait) |

| RSA | Plums – Yellow | $9.54- $10.08 (Dubai) | $8.72 – $12.25 (Dubai) |

| Australia | Nectarines (10kg) | $43.23 (Kuwait) | $46.53 (Kuwait) |

| RSA | Nectarines (3kg) | $3.60 (Kuwait) | $6.91 (Kuwait) |

| RSA | Nectarines | $8.17 – $8.72 (Dubai) | |

| RSA | Peaches (2.7kg) | $8.27 – $8.80 (Jeddah) | $8.27 – $8.80 (Jeddah) |

| RSA | Peaches | $9.45 – $10.08 (Dubai) | |

| Australia | Peaches (10kg) | $43.23 (Kuwait) | $46.53 (Kuwait) |

| RSA | Apricot (5kg) | $33.32 (Kuwait) | $11.86 (Kuwait) |

| RSA | Apricot (5kg) | $15.47 – $16.00 (Jeddah) | $15.47 – $16.00 (Jeddah) |

| RSA | Red Seedless | $8.72 (Dubai) | $11.99 (Dubai) |

| RSA | White seedless grapes (4.5kg) | $16.00 (Jeddah) | $16.00 (Jeddah) |

| RSA | White Grapes | $12.26 (Dubai) | |

| India | White seedless grapes (4.5kg) | $6.93 – $7.47 (Jeddah) | $6.93 – $7.47 (Jeddah) |

| India | White Grapes | $5.45 (Dubai) | $5.18 – $5.99 (Dubai) |

| India | Black Grapes | $5.72 – $6.54 (Dubai) | |

| RSA | Black Grapes | $8.72 (Dubai) | $10.35 – $10.90 (Dubai) |

| RSA | Tommy Atkins Mango (4kg) | $6.50 (Dubai) | $8.70 (Dubai) |

| RSA | Mango (4kg) | $6.93 (Jeddah) | $7.47 (Jeddah) |

India / Bangladesh

India

Apple market holding strong. Implementation of NON GMO is now as from 1 March shipping. The USA is currently not complying which should make India a good apple market this season. Plums and Imported Citrus are struggling to move to the final consumer, The first SA pears should be arriving soon and then we will know what the pear market is like.

Bangladesh

Egyptian Valencia appear to be losing their foothold as price levels slip below par.

Chinese pear prices have taken a bit of a dip in the short term due to an uncharacteristically large volume going direct to market in one go, thereby negatively affecting market levels.

This season has seen large volumes of Indian mandarins through the market, joined by those from Bhutan and now Pakistan has been added to the mandarin-mix. Bhutan supply should dry up soon, hopefully bringing relief to the depressed price levels. South African apple exports to Bangladesh are slowly picking up, however volumes are only a fraction of their former selves when compared with last years’ figures.

PPECB Statistics

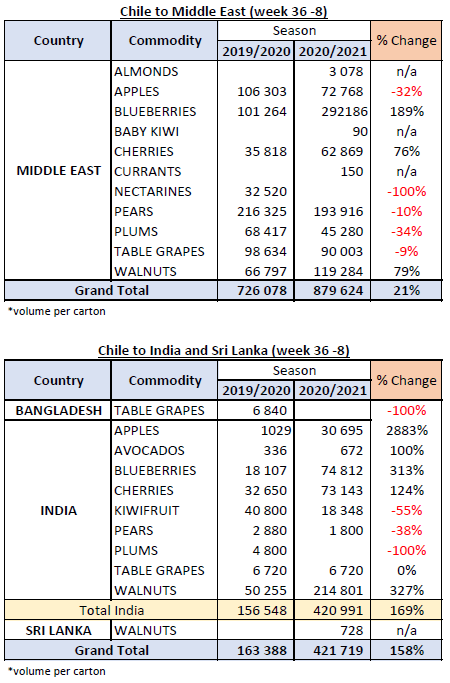

Decofrut Statistics

Follow links to our social pages