The Saudi Ministry of Health has announced that anyone who wants to perform the annual Haj pilgrimage this year will need to prove that they have been vaccinated for the Covid 19 virus.

Sales in the GCC countries remains slow and the market remains under pressure for most commodities. The impact of the coronavirus on the economy has resulted in many ex- pats working in the Middle East only receiving a portion of their salaries and therefore have no alternative but to send their families who are living with them in the country back to their native countries. The buying power and consumption is therefore lower. The hospitality industry has been negatively impacted since the start of the corona virus pandemic.

In Dubai, Retail supermarkets are quiet and even though supermarkets are running promotions ….. this has not generated high volumes of sales. Many supermarkets have even started having Pre-Ramadan sales even though Ramadan is only starting in the middle of April.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 84.77 BDT (Bangladeshi Taka) |

| 1.00 USD = 72.56 INR (Indian Rupees) |

| 1.00 USD = 15.03 ZAR (South African Rand) |

Citrus

Lemon inspections passed for export YTD is only -4% down compared to the same period last season.

Lemons to the Middle East – a decrease of 14% on cumulative volumes shipped to date compared to the 2020 season.

Market update: Despite fewer lemons being shipped from South Africa to the Middle East YTD, higher volumes can be expected to arrive in the market. This is due to vessel delays in South Africa as a result of equipment shortages/space constraints and this will have an impact on the market with vessels arriving at the same time. Although current market conditions/price levels seem to be stable on lemons, the market is still not moving volumes of fruit and demand remains low.

Market Prices

| Country | Variety | Selling Prices week 11 | Selling Prices week 12 |

|---|---|---|---|

| Lebanon | Navels (6kg) | $2.78 (Kuwait) | $3.62 (Kuwait) |

| Egypt | Navels (7kg) | $6.08 (Kuwait) | $5.28 (Kuwait) |

| Egypt | Navels (7.5kg) | $5.33 – $6.40 (Jeddah) | $6.40 – $7.20 (Jeddah) |

| Syria | Navels (7kg) | $2.78 (Kuwait) | $3.79 (Kuwait) |

| Spain | Lane Late Orange (9kg) | $8.53 – $9.33 (Jeddah) | $9.33 – $10.13 (Jeddah) |

| Spain | Navels (9kg) | $6.81 (Dubai) | $6.81 (Dubai) |

| Lebanon | Navels (14kg) | $8.56 (Kuwait) | $10.24 (Kuwait) |

| Syria | Navels (14kg) | $9.38 (Kuwait) | $11.90 (Kuwait) |

| Spain | Navels (15kg) | $11.90 (Kuwait) | |

| Egypt | Navels (15kg) | $13.10 (Kuwait) | $11.90 (Kuwait) |

| Turkey | Lemons (5kg) | $1.95 (Kuwait) | $1.97 (Kuwait) |

| Turkey | Lemons (10kg) | $7.73 (Kuwait) | $6.93 (Kuwait) |

| China | Lemons (15kg) cnt 100-113 | $15.20 – $16.00 (Jeddah) | $15.20 – $16.00 (Jeddah) |

| Turkey | Lemons (15kg) | $8.99 – $10.08 (Dubai) | $8.99 – $10.08 (Dubai) |

| Turkey | Lemons (15kg) | $13.51 (Kuwait) | $13.55 (Kuwait) |

| Egypt | Lemons (15kg) | $11.03 (Kuwait) | $11.07 (Kuwait) |

| Egypt | Lemons (15kg) cnt100/113/125/138 | $12.80 – $14.67 (Jeddah) | $12.80 – $14.67 (Jeddah) |

| RSA | Lemons (15kg) | $18.46 (Kuwait) | $17.69 (Kuwait) |

| RSA | Lemons (15kg) cnt 113/138/162 | $17.33 – $18.67 (Jeddah) | |

| RSA | Lemons (15kg) | $17.16 – $18.00 (Dubai) | $18.00 (Dubai) |

| Lebanon | Valencias (5kg) | $1.13 (Kuwait) | $1.00 (Kuwait) |

| Egypt | Valencias (7.5kg) | $1.13 (Kuwait) | $2.79 (Kuwait) |

| Syria | Valencias (8kg) | $6.93 (Kuwait) | |

| Egypt | Valencias (15kg) | $4.43 (Kuwait) | $6.10 (Kuwait) |

| Egypt | Valencias (15kg) cnt 72-100 | $5.33 – $8.00 (Jeddah) | $4.53 – $6.67 (Jeddah) |

| Lebanon | Soft Citrus (5kg) – Nova | $1.13 (Kuwait) | $1.14 (Kuwait) |

| Syria | Soft Citrus (6kg) – Nova | $3.60 (Kuwait) | $2.79 (Kuwait) |

| Egypt | Soft Citrus (8kg) – Nova | $4.43 (Kuwait) | $2.79 (Kuwait) |

| Australia | Soft Citrus (10kg) | $6.93 (Kuwait) | |

| Morocco | Mandarin (10kg) | $13.33 – $14.67 (Jeddah) | $16.00 – $17.33 (Jeddah) |

| Morocco | Soft Citrus (10kg) | $8.56 (Kuwait) | $8.59 (Kuwait) |

| Pakistan | Soft Citrus (10kg) | $5.25 (Kuwait) | $5.28 (Kuwait) |

| Pakistan | Mandarin | $4.90 (Dubai) | $4.90 (Dubai) |

| Turkey | Soft Citrus (10kg) | $6.91 (Kuwait) | $6.93 (Kuwait) |

| Spain | Mandarin (10kg) | $12.80 – $13.33 (Jeddah) | $12.80 – $13.33 (Jeddah) |

| Spain | Soft Citrus (10kg) | $5.25 (Kuwait) | $5.28 (Kuwait) |

| Turkey | Grapefruit (7kg) | $8.56 (Kuwait) | $8.59 (Kuwait) |

Pome

Market update: Continued downward pressure on price levels in the GCC countries due to an oversupply of pears from South Africa in the market. Very limited if any demand on summer pears. This is very concerning as pear sales are very slow with limited movement and can’t be stored for long without compromising the quality of the fruit. Only the winter Forelle/Vermont Beaut variety of pears can be stored for much longer periods.

Shipped YTD from South Africa

Apples to the Middle East – an increase of 25% on cumulative volumes shipped to date compared to the 2020 season.

Pears to the Middle East – an increase of 17% on cumulative volumes shipped to date compared to the 2020 season.

Market Prices

| Country | Variety | Selling Prices week 11 | Selling Prices week 12 |

|---|---|---|---|

| Italy | Granny Smith (18kg) | $28.37 (Kuwait) | $31.76 (Kuwait) |

| Serbia | Granny Smith (18kg) | $23.42 (Kuwait) | $28.46 (Kuwait) |

| France | Granny Smith (18kg) | $28.37 (Kuwait) | $31.76 (Kuwait) |

| Greece | Granny Smith (18kg) | $25.07 (Kuwait) | $28.45 (Kuwait) |

| USA | Granny Smith (18kg) | $31.76 (Kuwait) | |

| Italy / France | Granny Smith (18kg) | $23.16 – $26.25 (Dubai) | $23.35 – $23.60 (Dubai) |

| Italy | Granny Smith (18kg) cnt 100/113/125 | $21.60 – $24.00 (Jeddah) | $21.60 – $22.67 (Jeddah) |

| Italy | Golden Delicious (18kg) cnt 100/113/125 | $22.67 – $23.47 (Jeddah) | $22.67 – $23.47 (Jeddah) |

| France | Golden Delicious (18kg) | $25.07 (Kuwait) | $26.14 (Kuwait) |

| Italy / France | Golden Delicious (18kg) | $28.55 – $28.80 (Dubai) | $25.25 – $25.80 (Dubai) |

| USA | Red Delicious – PR (18kg) cnt 100-113 | $28.00 (Jeddah) | $28.00 (Jeddah) |

| USA | Red Delicious – XF (18kg) cnt 100-113 | $24.53 – $25.33 (Jeddah) | $24.53 – $25.33 (Jeddah) |

| USA | Red Delicious (18kg) | $26.72 (Kuwait) | $25.14 (Kuwait) |

| Italy | Red Delicious (18kg) | $25.89 (Kuwait) | $25.14 (Kuwait) |

| Greece | Red Delicious (18kg) | $25.07 (Kuwait) | $23.48 (Kuwait) |

| China | Fuji (18kg) | $16.81 (Kuwait) | $16.86 (Kuwait) |

| Ukraine | Royal Gala (18kg) | $24.24 (Kuwait) | $24.31 (Kuwait) |

| Turkey | Royal Gala (18kg) | $23.42 (Kuwait) | $23.48 (Kuwait) |

| Italy / France | Royal Gala (18kg) | $23.16 – $26.60 (Dubai) | $25.00 – $25.25 (Dubai) |

| Italy | Royal Gala (18kg) cnt 100 – 138 | $24.27- $25.33 (Jeddah) | $24.53- $26.13 (Jeddah) |

| Spain | Royal Gala (18kg) | $25.14 (Kuwait) | |

| Ukraine | Royal Gala (18kg) cnt 113-125 | $22.30 – $22.55 (Dubai) | $23.00 – $23.25 (Dubai) |

| New Zealand | Royal Gala (18kg) | $28.37 (Kuwait) | $28.45 (Kuwait) |

| RSA | Royal Gala (18kg) cnt 120 | $25.00 – $25.25 (Dubai) | $24.45 – $24.70 (Dubai) |

| France | Royal Gala (18kg) | $24.31 (Kuwait) | |

| Turkey | Pears (4kg) | $4.43 (Kuwait) | $5.28 (Kuwait) |

| Argentina | Pears (10kg) | $11.86 (Kuwait) | $12.72 (Kuwait) |

| USA | D’Anjou (10kg) | $17.65 – $18.00 (Dubai) | $17.65 – $18.00 (Dubai) |

| RSA | Williams BC’s Pears (12kg) | $11.00 – $11.25 (Dubai) | $8.00 – $8.25 (Dubai) |

| RSA | Rosemarie Pears (12kg) cnt 90/96/112/120 | $13.33 – $14.67 (Jeddah) | $12.80 – $14.40 (Jeddah) |

| RSA | Rosemarie Pears (12kg) | $19.46 (Kuwait) | $15.21 (Kuwait) |

| RSA | Rosemarie Pears (12kg) | $12.26 – $14.65 (Dubai) | $13.60 – $13.85 (Dubai) |

| RSA | Sempre Pears (12kg) cnt 90/96/112/120 | $10.67 – $12.00 (Jeddah) | $10.13 – $11.47 (Jeddah) |

| RSA | Sempre Pears (12kg) | $16.81 (Kuwait) | $15.21 (Kuwait) |

| RSA | Sempre Pears (12kg) | $8.72 – $11.95 (Dubai) | $11.00 – $11.25 (Dubai) |

| Chile | Coscia Pears (8.2kg) | $8.72 – $11.95 (Dubai) | $17.00 – $17.25 (Dubai) |

Grape, Stone & Kiwi Fruit

Grapes

South Africa has about one week left of packing in the Hex River area for the season. The last variety being packed is crimson red seedless grapes. Some of the last Barlinka black grapes, Dauphine white and Red globe was sent to the local market due to some quality issues that was picked up with the last packing of these varieties.

Market update: Continued downward pressure on price levels in the GCC countries and sales remain slow.

Shipped YTD – South Africa

Grapes to the Middle East – an increase of 2% on cumulative volumes shipped to date compared to the 2020 season.

Stone fruit

Continued downward pressure on price levels in the GCC countries due to an oversupply of plums from South Africa in the market.

Plum volumes exported from South Africa to the Middle East are up 28% (5% of this volume on black plums; 74% Red plums; 21% yellow plums). The balance of the volume has been exported to Europe representing 54% and 18% to the UK.

Market Prices

| Country | Variety | Selling Prices week 11 | Selling Prices week 12 |

|---|---|---|---|

| Italy | Kiwi (3kg) | $7.35 – $7.62 (Dubai) | $7.35 (Dubai) |

| RSA | Plums ( 5 kg) – Red and Black | $4.08 – $7.00 (Dubai) | $5.45 (Dubai) |

| RSA | Plums (5kg) | $5.08 (Kuwait) | $6.10 (Kuwait) |

| RSA | Plums – Yellow | $7.63 – $11.00 (Dubai) | $7.60 (Dubai) |

| Australia | Nectarines (10kg) | $39.93 (Kuwait) | $43.34 (Kuwait) |

| RSA | Nectarines (3kg) | $5.25 (Kuwait) | $5.28 (Kuwait) |

| RSA | Nectarines | $7.00 (Dubai) | $7.45 (Dubai) |

| RSA | Plums Fortune (5kg) | $6.40 – $6.67 (Jeddah) | $5.60 – $5.87 (Jeddah) |

| RSA | Peaches | $7.35 (Dubai) | $10.00 (Dubai) |

| Australia | Peaches (10kg) | $39.93 (Kuwait) | $43.34 (Kuwait) |

| RSA | Apricot (5kg) | $6.91 (Kuwait) | $6.28 (Kuwait) |

| RSA | Red Seedless | $12.25 (Dubai) | $11.40 (Dubai) |

| RSA | White seedless grapes (4.5kg) | $12.00 (Jeddah) | $9.33 (Jeddah) |

| RSA | White Grapes | $7.63 – $10.60 (Dubai) | $10.60 (Dubai) |

| India | White Grapes | $4.36 (Dubai) | $4.36 (Dubai) |

| India | Black Grapes | $5.45 (Dubai) | $5.45 (Dubai) |

| RSA | Black Grapes | $7.63 – $10.60 (Dubai) | $8.00 (Dubai) |

| RSA | Keitt Mango (4kg) | $10.30 (Dubai) | $8.00 (Dubai) |

India / Bangladesh

India

No report.

Bangladesh

The demand for South African apples in Bangladesh remains strong with good returns, however logistical challenges persist.

ZA Exporters are still managing to get fruit loaded, however this is becoming an increasingly arduous task by the week, this evident in the export stats compared to previous season.

Supply from South America seems to be an alternative, however long transit times and high freight charges are a rather significant deterrent.

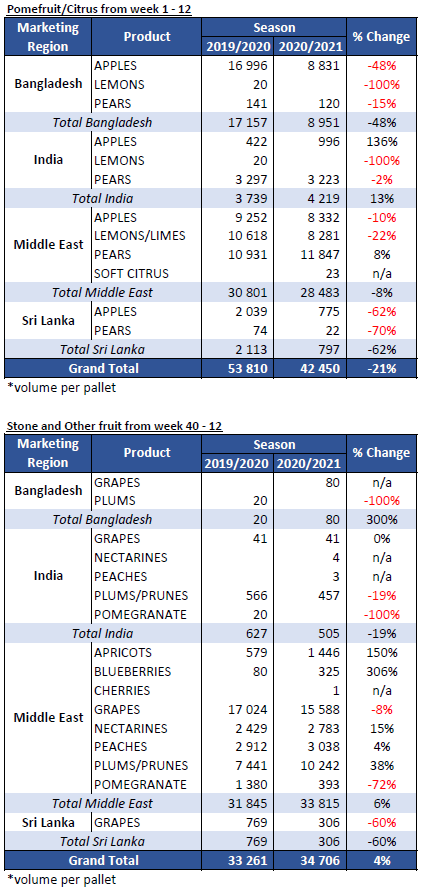

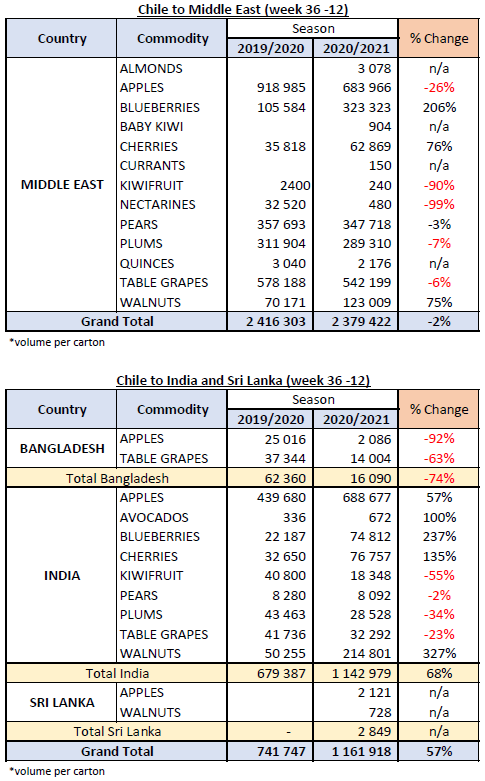

PPECB Statistics

Decofrut Statistics

Follow links to our social pages