Due to the Northern Hemisphere that is finishing with Royal Gala apples by the end of February, there will be a higher demand for apples from South Africa.

The market price levels are anticipated to increase for Mangoes from South Africa due to lower volumes of Keitt available from South Africa.

Downward trend on prices for Stone fruit as the market has a high volume of small fruit.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 106.26 BDT (Bangladeshi Taka) |

| 1.00 USD = 82.23 INR (Indian Rupees) |

| 1.00 USD = 17.08 ZAR (South African Rand) |

Citrus & Mango

The rain in the Northern region has delayed the picking and packing of Lemons.

Market update

The market is still supplied with lemons from Egypt, Turkey, and China. The early lemons from South Africa has not made arrival yet.

Mangoes – South Africa

Limited volumes on Keitt variety from South Africa and shipped YTD.

Market update

The anticipation is that the market price levels will increase due to less volumes shipped from South Africa.

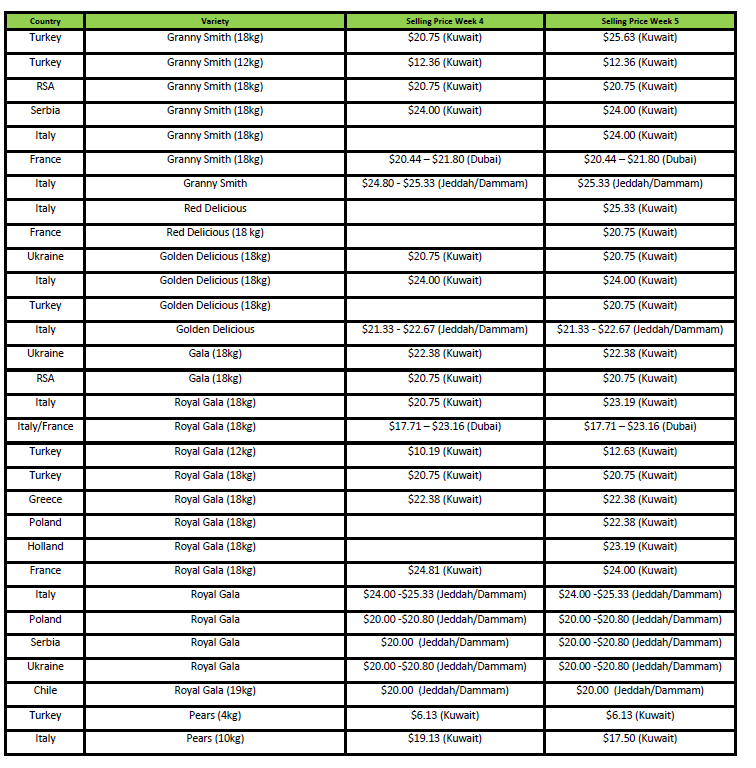

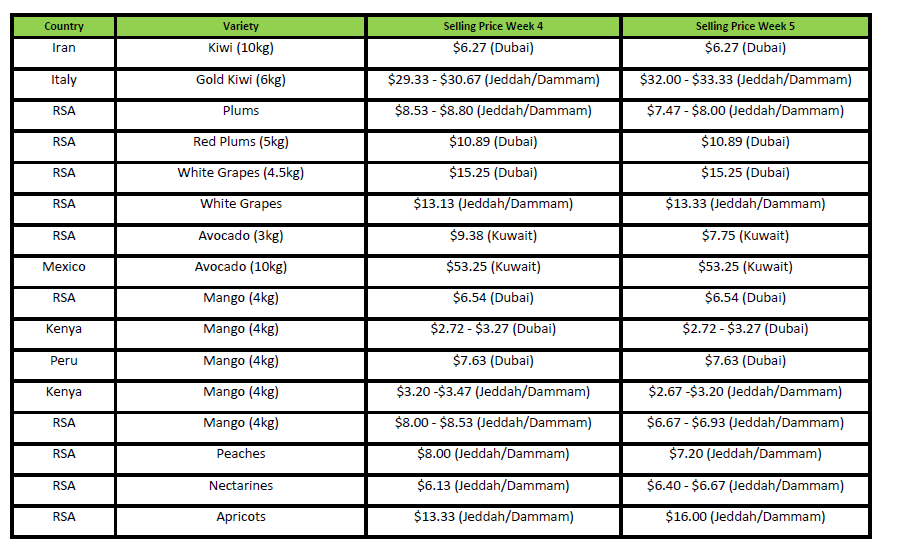

Market Prices (Dubai, Kuwait and Jeddah)

Pome

The season on the Rosemarie pears has ended out of the Ceres area in South Africa. The next summer pear varieties are being packed. There has been a decrease of 1% on cumulative volumes of pears shipped to date to the Middle East compared to the 2022 season. The pears shipped during this week (week 5) will make arrival for pre-Ramadan sales in Saudi Arabia.

Royal Gala apples from South Africa is 1-2 weeks earlier this season, whereas Brazil is 1-2 weeks later this season.

The South African Royal Gala apple crop will be down by 15% this season due to a big hailstorm in the Ceres area (one of the biggest apple-growing areas). Predictions are that sizing will be 1 size bigger (possibly peaking on a count 120). The growers will start packing in week 6/7.

Due to the Northern Hemisphere ending earlier this season, there is a higher demand for apples from the EU and UK.

Market update

The arrival of the first summer pears in Dubai market was sold at high price levels, however the market anticipates that price levels will start to decrease as more volume is sent to the Middle East market over the next few weeks.

Market Prices (Dubai, Kuwait and Jeddah)

Grape, Stone, Kiwi Fruit, Cherries

Grapes

The Red Globe out of the Hex Valley area is earlier than anticipated. Some growers started packing in week 3 with limited volumes. Traditionally packing only starts in week 6.

The Limpopo area finished packing in week 3 and Orange River did not harvest, while the Berg River was a disaster after the lack of winter rain, and then the Summer floods.

The total estimate for South African Grapes is about 15% down and forecasted to 65.5 million compared to the original estimate of 77 million. The Hex River area is however 2 million cartons ahead of the 2022 season.

Stone Fruit

The packing on the Laeticia red plums has only just started with minimal volumes currently being packed out of the Stellenbosch area, however, there seems to be less volume on this variety compared to last season and in the Berg River area, the Laeticia plums are smaller in size this season. The harvest on the Angelino black plums is anticipated to start in week 7 (mid-February).

Cherries

No report.

Market Prices (Dubai, Kuwait and Jeddah)

India / Bangladesh

India

Plum market strong for first arrivals. Price is dropping as more plums make arrival. Pear market prices have picked up slightly as the market awaits the new season summer pears from SA. Large volumes of WBC are enroute.

Bangladesh

Apple market is strong with minimal arrivals and apples being shipped now will make pre-Ramadan arrivals. LC’s are still a problem and will be for the foreseeable future.

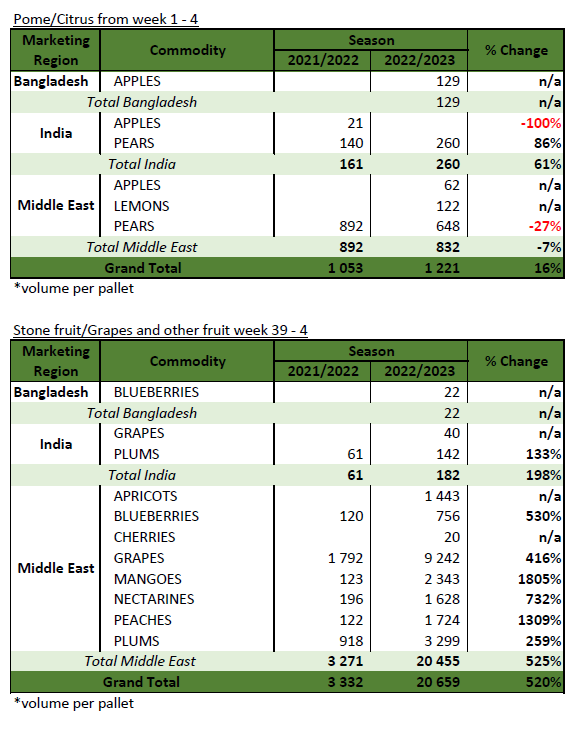

PPECB Statistics

Decofrut Statistics

Follow links to our social pages