Update on Cape Town port in South Africa

Due to extreme weather conditions (strong winds), Cape Town port has had to close all port operations, as the situation has reached a critical point where there are no more plug points available in the Western Cape. Transporters are therefore not able to accept any further loads. The port will remain closed until further notice.

Update on the market in the GCC countries

South Africa and Chile will compete with Royal gala apples from Poland in the market at competitive price levels and price will be an important factor this season and on all commodities. The overall buying power is less with increased taxes, and with many expats that have left the Middle East over the last few years.

There is uncertainty as to how the earthquake in Turkey will influence the supply of lemons to the Middle East market.

| 1.00 USD = 3.67 AED (Emirate Dirham) |

| 1.00 USD = 3.75 SAD (Saudi Riyals) |

| 1.00 USD = 106.05 BDT (Bangladeshi Taka) |

| 1.00 USD = 82.80 INR (Indian Rupees) |

| 1.00 USD = 18.24 ZAR (South African Rand) |

Citrus & Mango

The packing of lemons has been delayed by 2 weeks due to heavy rainfall in the Northern areas.

Market update

There is uncertainty around how the recent earthquake in Turkey is going to influence the supply of lemons going forward. Either there will be less volume going to the market, alternatively Turkey might store lemons and send a high volume to the Middle East market once ports re-open and repairs are done to infrastructure affecting logistics and transport.

Mangoes – South Africa

The rain in the Limpopo province continues to delay the picking and packing of Mangoes. There is 2-3 weeks left on the packing of mangoes.

Market update

Continued positive market trends and market price levels due to less volumes shipped from South Africa.

Market Prices (Dubai, Kuwait and Jeddah)

Pome

South Africa is at the tail-end of the packing of the summer pear varieties. The last of the Flamingo, Cheeky, Flamingo Sempre and Cape Rose varieties are currently being packed. There is expected to be about a 2 week gap before the packing of the first Forelle and Vermont beaut winter pears.

The current closure of port operations in Cape Town port until further notice due to weather conditions is very concerning as we need to ship the tail-end of the summer pears and the new season apples.

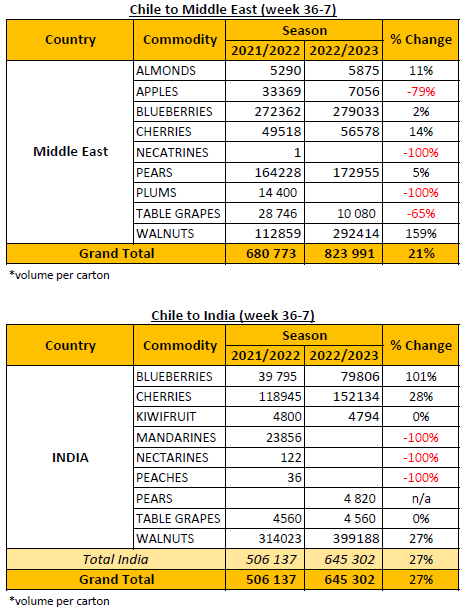

Chile

Chile are starting with their first harvest of new season apples.

Market update

The Middle East market is ready to start with the new season Royal Gala apples from South Africa, however price will be the most important factor. South Africa and Chile will compete with Poland at competitive prices.

Market Prices (Dubai, Kuwait and Jeddah)

Grape, Stone, Kiwi Fruit, Cherries

Grapes

The Berg River Region is at the tail-end of packing with 2 weeks left of packing.

The Hex River region is anticipated to finish packing by week 10, with about 10 to 15% less volume compared to last season.

In general, the crisis in Peru has led to an interest from non-traditional markets, which will present growth opportunities in the future.

Chile

Some early growers started packing Red Globe grapes from week 5-6 with limited volumes, however most growers will start packing towards the end of next week (week 8) onwards.

Stone Fruit

There has been an increase of 31% on cumulative volumes of Nectarines shipped to date to the Middle East compared to the 2022 season. A high volume of Nectarines was shipped to the market in week 3 (middle of January) and the market is under pressure.

There are concerns that the Middle East will be under pressure on plums due to higher volumes being sent to the market. Vessel delays in Cape Town due to port closures, can result in vessels bunching and arriving in the market simultaneously and this will not help the current situation.

Cherries

No report

Market Prices (Dubai, Kuwait and Jeddah)

India / Bangladesh

India

No feedback.

Bangladesh

No feedback.

PPECB Statistics

Decofrut Statistics

Follow links to our social pages